Venture firms have been buying stock on secondary markets in quasi-public companies for some time. This means they’re buying stock from other stockholders, not investing money into the company. They’re doing it because they think the stock is cheap and there are still venture level returns to be made. And they’re also doing it for marketing purposes, to put the cherished company logo up on their website as a portfolio investment.

Elevation Partners bet the house on a massive Facebook secondary market transaction in 2010, for example (it was a good bet). Facebook is listed as a portfolio investment on the Elevation site.

Andreessen Horowitz also does this – their investments in both Facebook and Twitter were both secondary market transactions. Both companies are listed prominently on their portfolio page.

Kleiner Perkins also lists Facebook as an investment on it’s Digital Growth Fund page, although it takes a bunch of clicks to get there. Their main portfolio page does not list Facebook. The firm bought shares in the secondary market.

Competitor venture capitalists hate this – a portfolio page listing a Facebook investment could mean a late stage secondary deal made without the knowledge of Facebook, or it could mean a very early investment at a $100 million valuation (Accel, in that case) when everyone thought you were crazy for putting money behind a Harvard dropout.

Sarah Lacy wrote a post on TechCrunch earlier this year (with a really handy chart) showing which firms invested in which companies when and at what valuations. It really shows how much of a difference there is.

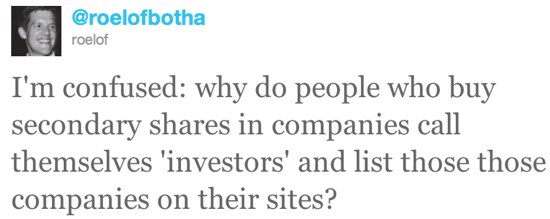

This is inside baseball, but most of the really interesting stuff is inside baseball, in my opinion. So when you see Roelof Botha at Sequoia Capital talking about the issue publicly on Twitter (see image above), that’s what’s really going on. Marketing, positioning, and future deal flow. As well as genuine frustration about what the ground rules are for VCs.

Disclosure – every venture firm mentioned in this post (or their individual partners), except Elevation Partners, is an investor in CrunchFund. I keep meaning to put up a website showing all of their logos.