There are a lot of different kinds of people in this world. I’ve found that I get along best with the ones that are brutally honest.

Earlier this evening I interviewed Vinod Khosla at the jam-packed Startup Weekend Seattle event. We had a long talk – nearly an hour in total, which is a lot longer than most interviews I do and allowed us to take a deep dive on a number of issues important to Vinod. There’s good coverage of the event at Xconomy, GeekWire (again) and AndrewDumont.me.

What strikes me most about the man aren’t his views on technology or venture capital, but his communication style.

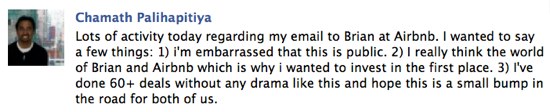

During the pre-interview prep I carefully brought up an issue that I’ve heard from a number of people – that Vinod is somewhat “difficult.” “I hear he can be a massive pain in the ass,” someone told me last week while asking if he’d be a good potential investor for their startup.

So I asked Vinod about it, and carefully watched his reaction. I did not want to ask him this on stage if it was going to make everything go sideways. He chuckled, said this was a fine topic to discuss on stage, and asked me if I’d read the quote on the Khosla Ventures site about brutal honesty. I hadn’t, but here’s what it says: “We prefer brutal honesty to hypocritical politeness.”

He told me stories, and then repeated them on stage, about a variety of entrepreneurs he’s been “brutally honest” with. A startup that still had $50 million in the bank when he realized with certainty that they’d fail and suggested they shut down and liquidate. Two years later, he says, they had $3 million left in the bank and sold for $2 million. Yes, I double checked those numbers with him – the company sold for less than the cash they had in the bank (there are a variety of reasons why this can make sense for the sellers).

He told me stories, and then repeated them on stage, about a variety of entrepreneurs he’s been “brutally honest” with. A startup that still had $50 million in the bank when he realized with certainty that they’d fail and suggested they shut down and liquidate. Two years later, he says, they had $3 million left in the bank and sold for $2 million. Yes, I double checked those numbers with him – the company sold for less than the cash they had in the bank (there are a variety of reasons why this can make sense for the sellers).

He talked about passing on investing in Joe Krause’ Jot because it wasn’t, in his opinion, a big enough idea. And he talked about how he gives his brutal, unvarnished opinion to entrepreneurs who seek his attention and money.

VC’s give lots of reasons for turning down a startup, he told me. Things like “it’s too early,” or “it’s too late,” or “I couldn’t get my partners comfortable with it.” Those are the easy ways out, he says. He prefers to give the exact reason. The one he seems to give most often is that the idea simply isn’t big enough to matter.

It’s tough to hear those kinds of things as an entrepreneur, and it’s no wonder some of them pass along their opinion that he’s a “pain in the ass.”

In my world I’ve had to learn about brutal honesty in a couple of different ways. The first is when you first hear a startup pitch and you know it’s not going to make it. I’ve tried the brutal honesty approach in the past, and some percentage of those entrepreneurs become enemies, sometimes lifelong enemies. I’ve tried a softer, more polite approach. In those cases the entrepreneur remains eagerly on the hook. If you don’t respond later, though, you get the same result.

In my world I’ve had to learn about brutal honesty in a couple of different ways. The first is when you first hear a startup pitch and you know it’s not going to make it. I’ve tried the brutal honesty approach in the past, and some percentage of those entrepreneurs become enemies, sometimes lifelong enemies. I’ve tried a softer, more polite approach. In those cases the entrepreneur remains eagerly on the hook. If you don’t respond later, though, you get the same result.

After years of tinkering I’ve found two excellent ways of minimizing the damage from these people. If I’m at a tech event in public I put on my full (invisible) body armor. Smile, shake hands if I must and perform the right type of theatrical engagement. “Amazing. Love to hear more. Do you have a card? I’ll contact you.”

That contact never comes. And for some reason far fewer people ever become upset v. the other ways of handling things.

I really don’t like doing this, but it’s the one thing that keeps me sane and allows me to continue to engage with the community. And every once in a blue moon someone does manage to sneak in past the armor and make a lasting impression on me. Still, I’d rather be more like Vinod in this way, and I’m going to experiment to see if I can make it work.

Here’s the other way brutal honesty works for me – in chasing down a story or interviewing someone. I just ran across this story on VentureBeat this evening from September 16. I believe it gives a good overview of how I conduct myself in interviews. I ask a hard question. I get “bullshit, bullshit, polite nonsense bullshit” in response. I respond that my question wasn’t answered, and ask again. and again. and again. And then, finally, for example, Kevin Rose admits he sold much of his Twitter stock over the summer. Or Matt Cohler, after three tries, simply gives me that look that suggests I stop asking him if he’d invested in Dropbox. Or Carol Bartz gets so frustrated with my attempts to penetrate through the haze of bullshit that she yells “so fuck off!”

I’m not trying to make people uncomfortable on stage. I respect (eventually) their refusal to answer and simply move on. But what drives me crazy are the people who are so politicized and media trained that they can speak for hours about everything in particular but never answer the question I’m putting to them. I appreciate their art, but I don’t respect their unwillingness to engage in the truth.

Bad news, good news, no news, it should all be spread truthfully and succinctly. There are exceptions, but they can usually be dealt with by saying “I’m not going to answer that question,” and we can move on. That’s why I enjoy interviewing certain people more than others.

Doug Leone plays it straight and fears no question. Marissa Mayer is excellent at going deep on issues she likes, and skirting those that she doesn’t. But she doesn’t engage in idle bullshit. Roelof Botha, Ron Conway, Josh Felser, Jeff Clavier, Dave McClure are all straight shooters. Reid Hoffman will talk about anything at all with the innocence of a newborn (he sleeps well at night, I think). Matt Cohler, who was whelped by Hoffman in a previous life at LinkedIn, is much the same way. His trademark move, though, is to simply stare you down silently when you ask something he doesn’t like. It’s direct, communicative and it works. I often simply move on. When I talk to John Doerr, on stage or off, I get the distinct feeling that the man can create matter from the swirls of his words. I don’t know if that’s bullshit or honesty, but it keeps me interested and, I admit, willing to imagine a better world is actually possible.

Sometimes people call me a jerk for the way I interview these people. I get why they think that. But I think I do a good job of showing off the shiny parts of a person’s achievements, and letting them get their words out to the world. When I cut them off, it’s only because I expect more from them. Better. These people keep coming back for interviews year after year, so I know they’re not entirely unpleased with the experience.

Back to Vinod…All this brutal honesty seems to be working out nicely for him. Entrepreneurs come back to him time and time again as they move from one startup to the next. They often take significantly lower valuations to be part of his family. Just this week, in fact, a startup I’ve invested in took a term sheet from Vinod valuing the company at $6 million. Another very good firm was offering $10 million. I asked him why he did that. “Because a startup with Vinod is a lot better than a startup without Vinod,” he said.

Back to Vinod…All this brutal honesty seems to be working out nicely for him. Entrepreneurs come back to him time and time again as they move from one startup to the next. They often take significantly lower valuations to be part of his family. Just this week, in fact, a startup I’ve invested in took a term sheet from Vinod valuing the company at $6 million. Another very good firm was offering $10 million. I asked him why he did that. “Because a startup with Vinod is a lot better than a startup without Vinod,” he said.

Which says it all. Direct, brutal, no frills, awesome, wonderful, honesty. Versus being smile fucked by someone who’s hypocritically polite. I’ll take the honesty any day for the win.

Disclosure: Khosla Ventures is an investor in CrunchFund. I think this is kinda rad.