Luxury vacation home startup Inspirato (affiliate link, see below) has closed another round of financing – $20 million from Institutional Venture Partners, at a rumored valuation that’s significantly higher than the last round of funding closed last October.

This is a significant up round for one of our portfolio companies, and we’re proud to be part of the team.

Our investment last year wasn’t typical for CrunchFund. Most of our investments are in very early stage, often pre-launch, startups. But we’ve earmarked 20% or so of our fund for later stage investments that we see as extremely opportunistic. Inspirato, a company I’ve been tracking since it launched in February 2011, is exactly the kind of company we like to back. We appreciate Kleiner Perkins’ willingness to allow our relatively small investment in the round that they led.

It’s amazing to think of Inspirato as “later stage” when it’s less than a year old, but the company has been absolutely killing it. They take out long term leases on luxury vacation properties and then rent those properties to users at prices that are significantly lower than they can get elsewhere. You can often get a 4-5 bedroom house for about the same price as you pay for a normal room at a Four Seasons. If you’re traveling with a family or friends, it is far less expensive to use Inspirato than even more moderately priced hotels.

This model – “luxury for less” – clearly resonates with customers.

There is a membership fee for Inspirato, and a yearly fee. The company looks to those fees to provide the bulk of operating margins, which allows them to continue to offer rentals at a significantly discounted rate. Cofounder Brad Handler has referred to this as the “Costco model,” where Costco makes money off membership fees while keeping margins on retail goods extremely low.

Now about that affiliate link. As I explained in my blog post when CrunchFund first invested, Inspirato offers its members a $1,000 credit for convincing new users to join. If you sign up with my affiliate link I’ll simply transfer that credit to you. A lot of my friends have already signed up, and I’m happy to give away the credit. We’ll make it up, after all, as investors.

In November I wrote about a New York Times article

In November I wrote about a New York Times article  My CrunchFund partner and long time colleague MG Siegler is having what appears to be a

My CrunchFund partner and long time colleague MG Siegler is having what appears to be a

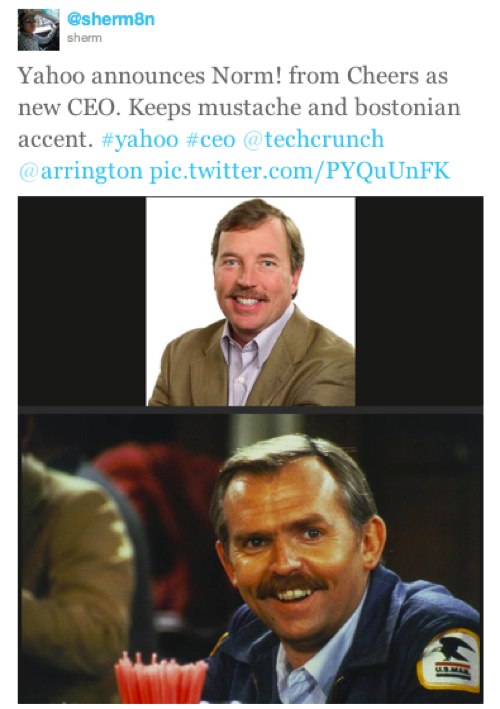

Path and others are giving us what we want – A nice, sophisticated and diverse conversation with friends, like sitting together at a table just laughing and talking and drinking a latte. Facebook is more like the top picture above. Chaos.

Path and others are giving us what we want – A nice, sophisticated and diverse conversation with friends, like sitting together at a table just laughing and talking and drinking a latte. Facebook is more like the top picture above. Chaos.