Sarah Lacy wrote about acqui-hires this weekend on Pando Daily. She got some things wrong.

The main problem is her argument doesn’t work on its face. The logic breaks.

She says that all the interested parties love acqui-hires – entrepreneurs get an easy out, buyers get engineers, and investors get a free pass.

But she also says acqui-hires have to stop. In the world she’s describing, which is a three party circle jerk, I don’t see where the pressure would come from to stop them.

In reality investors don’t like acqui-hires at all. An acqui-hire is marked down as a “fail” in the books. In almost every case we’d much rather have the entrepreneur keep fighting for a win even at very long odds.

That being said, we don’t complain about them or try to stop them. But some investors do and will. That’s why there has been academic and legal interest in finding ways to plan ahead for acqui-hires in financing documents.

The idea would be to make them less attractive to entrepreneurs, or at least to give investors a bigger piece of the pie when they happen.

As investors, we never see an aqui-hire as something like getting our money back when we buy a lottery ticket. Like I said above, it’s just a loss. If every company we invested in did an acqui-hire our fund would perform terribly and we wouldn’t be doing this for very long.

Sometimes a company is just done and an acqui-hire is the best solution for them. But most of the time companies still have a fighting chance, and an acqui-hire is just the easy way out.

The article that needs to be written is how many entrepreneurs today expect an automatic Hollywood ending to their startup. No one is preparing them for the extremely hard times ahead, and they seem to be going in blind.

Nick O’Neill also has a good rebuttal.

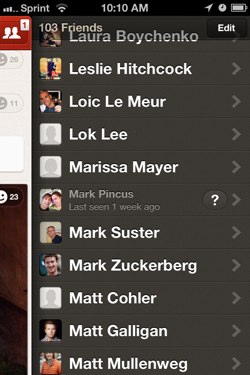

If you haven’t updated Facebook on your iPhone yet, do it now.

If you haven’t updated Facebook on your iPhone yet, do it now.  Went to Detroit this week. It’s a lot nicer there (at least in the burbs where I was) than I thought it would be.

Went to Detroit this week. It’s a lot nicer there (at least in the burbs where I was) than I thought it would be.  Not long after that

Not long after that  There was a little-covered feature of the

There was a little-covered feature of the