The news that Yahoo CEO Scott Thompson has lied about having a computer science degree is now four days old. Neither Yahoo nor Thompson have denied that this happened or have presented any sort of story that mitigates the damage. And as of today Thompson still has his job.

I understand that it’s been a long while since Yahoo was able to hold its head high in Silicon Valley. It seems like yesterday, but the company has been ridiculed since early 2008 when they absolutely bungled the Microsoft acquisition attempt. For shareholders, employees and users, it’s been all downhill from there.

It doesn’t matter. It doesn’t matter if Yahoo is a shadow of its former self. Employees still get up every morning and come to work and do their best in a difficult environment. These are good people – not all of them have left or been terminated over the years. And they deserve a CEO that they can believe in.

And so does the community.

We are still a community. Despite all the competition, all the fighting and the insane amounts of money flowing around us, Silicon Valley is a community. There is an incredible willingness for people to help each other. It’s the only reason I’ve stuck around.

The ups and downs of the valley move in cycles. Even in 2007 I was bitching about how we needed a downturn. “Times are good, money is flowing, and Silicon Valley sucks,” I wrote. That was nothing compared to today.

When all the money goes away so do most of the jerks. That happened in 2001 and everything was great for half a decade. The people that were here were here for the right reasons. Enough of the others had slipped away in the night that life was unquestionably pleasant in the valley.

Now the money is back and then some. And the kinds of people who hung out here in the late 90s are back too.

Yes, we get a regular lineup of jerks here, just like everywhere else. Thompson isn’t the first person to screw up.

But in the past at least people seemed a little embarrassed by their actions, there was some display of shame. There were some basic standards people were held to. Right?

Today we have a Yahoo that seems to be standing by their man. A man who lied about who he is.

And I’m not talking about the shame of having a CEO who doesn’t have a computer science degree. That’s irrelevant. What’s hugely relevant is that a man who’s willing to lie about something like that has not only risen to the level of CEO in a famous public company, but that the company is also willing to stand by him when the lie is revealed.

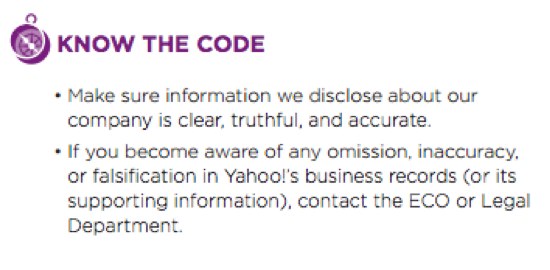

How can Yahoo hold its remaining employees to its code of ethics, which the CEO has clearly and egregiously violated? How could Thompson even show his face after that? How did the board of directors not revoke his security card?

It’s all about the money, apparently. Which is a damned foolish way to do business, in my opinion.

Yahoo has hit rock bottom. There’s really nothing else they could do to fuck things up further.

Which is an excellent opportunity to really do something crazy. Clean house, bring in a leader who cares about product and who cares about integrity. Someone who makes no sense at all on paper, but makes all the sense in the world on the ground.

Someone who doesn’t think the answer to all problems is more layoffs. Someone who instead energizes thousands of employees into doing more, giving more, creating more.

Someone who isn’t there for the multi-million dollar golden parachute if things don’t work out. Someone who cares far more about product than about the business model.

Someone old enough to have lived through Steve Jobs bringing Apple back from the grave in 1997, but young enough to still think they’re Superman and unstoppable.

Someone who let’s Yahoo employees hold their head high when walking down the street.

Someone who isn’t so insecure that he lies on his resume and so unapologetic that he doesn’t even have the stomach to resign after he’s been caught.

Someone better than that.

I’m happy to announce that

I’m happy to announce that