I wrote some tweets today at TechCrunch Disrupt Berlin.

At a very high level, here are the problems I see with where Disrupt is going:

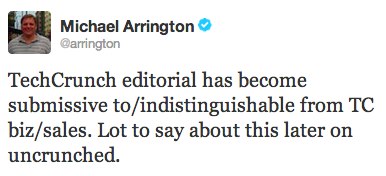

1. I get that this is turning into a very big business for Aol. But TechCrunch Disrupt should be a conference with a focus on editorial, not sales.

2. Editorial at TechCrunch seems to be completely submissive to sales. If sales wants something, it happens. Way too many sponsors on stage, for example. And the speakers are nearly constantly herded to “VIP events” that are really just sponsor events where sponsors pay to have a captive audience of well known entrepreneurs and venture capitalists. Speakers are being packaged and sold to sponsors, and they are complaining about it.

3. Picking the winner of the battlefield startup competition should be free of any influence of non-editorial people and judges. The only people who should be in the room to decide who wins the battlefield should be the judges and the editors, and the editors shouldn’t be voting or trying to influence decisions.

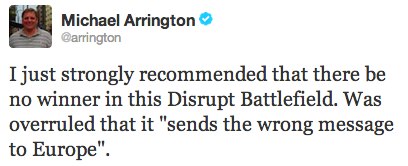

4. It should be completely reasonable for judges to discuss the option of not having anyone win the battlefield at all if the quality level isn’t there. TechCrunch management today didn’t allow that conversation to happen, saying it would send the wrong message. Those people shouldn’t even be in the room, let alone directing the conversation.

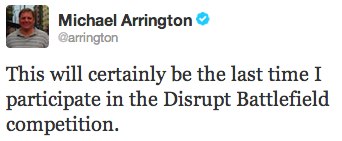

TechCrunch should be strong enough to withstand criticism, and I hope they understand that I give this advice out of love, not malice. In any event, I’m not going to participate in the battlefield in the future.

Twice a year

Twice a year