My mouth fell open, literally, as I read the extremely private email from investor Chamath Palihapitiya (pictured) to Airbnb CEO Brian Chesky. The message in the email was fine, even reasonable. But the fact that it was leaked to the press, and contained so many incredibly sensitive confidential financial details about Airbnb and its founders, amazed me.

My mouth fell open, literally, as I read the extremely private email from investor Chamath Palihapitiya (pictured) to Airbnb CEO Brian Chesky. The message in the email was fine, even reasonable. But the fact that it was leaked to the press, and contained so many incredibly sensitive confidential financial details about Airbnb and its founders, amazed me.

Disclosure: CrunchFund is an investor in Airbnb.

The face that the email was between just two people (meaning very low chance of a random leak) and was written way more carefully than quick communications normally are, led me to immediately assume that Palihapitiya has some kind of crazy agenda to hurt the company.

Mouth still open, I was preparing to write a story about how suicidal this was for Palihapitiya – clearly no startup would ever trust him with confidential information again. They’d fear that if he didn’t like the deal he’d just publish all those details.

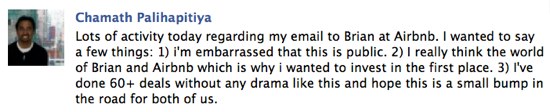

Luckily Palihapitiya picked up the phone when I called. He insists it wasn’t a purposeful leak, and he’s horrified that it’s now public. He says that he believes that his assistant forwarded the email to her boyfriend and that it was forwarded from there, directly or indirectly, to Kara Swisher. (we just spoke again, he says he’s fairly certain it wasn’t a leak from his team). He’s still trying to understand exactly what happened, he says. In the meantime, he gave me this statement:

I believe we know the source of the leak and are taking decisive action to address it. I’m very sorry this is being publicly dragged out right now. This really was just an attempt to give Brian private feedback on how to think about these things.

Here’s the original email. Which, again, has reasonable points. But it contained information that Palihapitiya only knew because he was evaluating an investment. The fact that it was made public is a serious problem for him.

Update: It’s worth noting that Swisher has edited the email. In her original post the email showed a “Cc Marc, Reid, my deal team” – I assume that’s Marc Andreessen, Reid Hoffman, etc. It’s interesting that she removed that without noting it. I wonder why…

Update 2: From Chamath’s Facebook profile:

From: Chamath Palihapitiya

Date: Sat, 1 Oct 2011 11:16:05 -0700

To: Brian Chesky

Subject: Airbnb financing…Brian,

Thanks again for giving me the chance to participate in your latest financing. I had a chance to review the docs at length yesterday and I wanted to follow up as, quite honestly, I’ve never seen a deal like this over ~60 investments I’ve done and I’m pretty concerned.

I’m all for getting the best valuation you can, minimizing dilution and maximizing control. We did this brilliantly at Facebook…all of our financings (except our first $$$ from Peter Thiel) were done not out of necessity but opportunity. As such, our investors had virtually no control and it resulted in a much better outcome. As we’ve discussed, I generally don’t believe investors add much to a success story and so minimizing their impact is a great strategy when you are onto something that is working.

This said, while several of these concepts are reflected in the current deal, there is one big thing that I am fundamentally against and violates my principles and will prevent me from participating in your round. When I saw that you guys were taking $31M out of the company, I didn’t think much of it as I just assumed it would entirely be via a secondary sale.

But as I understand the deal, it seems that you are doing only $9.6M in secondary and $22.5M as a dividend to common (of which $21M goes to you and your co-founders). I am really uncomfortable with this and don’t think its in the spirit of building a good, long term business. Effectively, it is a strategy that allows you guys to take money out of the business and not dilute yourself — I’m not sure why this is such a big deal when you guys are almost 90% vested and the financing is at $1.2B where your dilution is marginal. Further, it excludes many of the employees that probably have helped you and your co–founders get the company to this place as most of these folks probably don’t have any stock but have unexercised stock options and thus won’t get a dividend.

My basic principle on this stuff is that if you want liquidity, that’s fine, but you should make it available to everyone. Otherwise, no one should get it. Your current deal is the farthest away from this principle that I’ve seen in a while…this strategy has been done once before — at Groupon. We can see how “well” they are doing and how short term the investor community is now viewing their motives. I really think you can do better than this…and that you are better than this.

Separately, when you look at successful tech companies, it seems that dividends are an approach used by cash rich operations to distribute excess earnings — in fact, the most successful, cash rich tech company in the world, Apple, hasn’t issued a dividend and they have more than $75B in cash! Again, while I think Airbnb will be a good company, this is nowhere near the truth now — you guys still need to scale and build this thing for the future.

I really think you are onto something but I would implore you to not take the easy way out. Treat your employees the same as you’d treat yourself. Do things that you will be proud of and can defend to anyone including your Board, employees, prospective hires etc. In such a competitive hiring market, you are competing with not just your obvious competitors, but also any successful tech company who is also looking for great talent. A principle that treats your employees as well as you’d treat yourself is a huge strategy for differentiation, retention and long term happiness of the exact types of people you will need to be successful. In contrast, if you are viewed as self-dealing and shady, it will only hurt your long term prospects…

In summary, I’m passing on this financing because I strongly disagree with what’s going on. I’m not sure who advocated this approach but I did mention this to Reid [Hoffman, another Airbnb investor via Greylock Partners] last night and he was of a similar mind to myself and surprised this was the approach being taken. If you want some good advice — I would ask that you consider pinging him about different ways to think about going about the liquidity portion.

If you change your mind on how to close this financing, let me know and I’d love to reconsider. Otherwise, good luck and lets keep in touch.

Take care,

Chamath

Can’t there be a clause in the paperwork that the Investors sign that prevents them from doing this ?

It sounds like he never signed anything. But that’s not the issue anyway. The issue is that he’s an investor, and this email becoming public absolutely crushes Airbnb. In the future startups would be extremely hesitant to give him this kind of access again. That’s why it’s important that he cleans this up completely, soon.

Michael – i posted below but wanted to add to this thread as well. I’ve known Chamath for several years. First, at Facebook and now as an investor in my current company. There is just no way he would ever ever leak something like this. He’s got too much integrity to play these kind of games. While this is clearly very unfortunately doesn’t affect what i would share with him one bit. I trust him 100%.

I wouldn’t be so sure of your assessment about Palihapitiya. Numair Faraz recently wrote a piece called “I was once a Facebook fool” detailing his experience trying to launch Audio on the Facebook platform a few years back when Facebook brought on Palihapitiya, and it doesn’t paint him in a flattering light — he comes off as a skilled operator of Silicon Valley politics. Names were redacted from the final piece, but there is an interesting discussion on Hacker News with more details from the author. While I think it would be suicidal for Palihapitiya to have directly leaked this email to Swisher seeing as he has just established his VC fund, he certainly could have had a hand in having it indirectly leaked. The way the email was written, as Arrington pointed out, reads like it was meant to be leaked. And I’m not buying the story that his assistant forwarded it to her boyfriend as the source of the leak. That’s just ridiculous scapegoating.

@ charlie (below). I can’t speak to the specific anecdote you are referring to but while at FB Chamath was was alway direct, no bullshit and honest. While you may not have agreed with him, you always knew:

a) when he was in the room

b) where he was coming from because he said it clearly and to your face.

I experienced this first hand in every single encounter with him. I have zero hesitation about him and his character. I trust him completely. There is just no way – no way – he would do this.

@Jonathan Numair Faraz’s story details a very specific incident where Palihapitiya was dishonest and duplicitous with an external partner while at Facebook. Perhaps Palihapitiya had a different ethical standard for dealing with internal FB employees, or perhaps the truth really lies somewhere in the middle. Nonetheless, I think it is entirely possible that this leak and the ensuing denial could have been engineered from the get go. To me, the email reads almost like an ill-conceived self promotional stunt gone bad.

Compare the writing style in his “private email” to Chesky with the internal email he wrote to his troops upon leaving FB:

Which one seems more like “informal advice?” This was written for the public.

Arrington is amazing and usually right, but I think here he’s wrong that this missive was written with knowledge that it would be leaked. The long-term damage to Chamath’s reputation for sending an email like this one belies the notion that he intended its contents for the public eye. Unless, of course, you assume that Chamath is massively irrational + that he has a personal vendetta against Airbnb. But I don’t see any evidence of either assumption here.

Completely agree with you Jonathan. I’ve known Chamath since we worked together at AOL/Spinner. Absolutely no way he had anything to do with this leak. He has way too much integrity (not to mention intelligence) to do something like that. This was honest, straightforward & heartfelt advice (not to mention sound).

Hey Jonathan, ask your investor how many Facebook Platform companies he had equity in…

I have a problem with the following statement:

“He says that he believes that his assistant forwarded the email to her boyfriend and that it was forwarded from there, directly or indirectly, to Kara Swisher. (we just spoke again, he says he’s fairly certain it wasn’t a leak from his team). ”

Did Chamath tell you that his assistant forwarded the email to her boyfriend? If SO, case closed. Chamath is the source of leak and it is consistent with the writing style indicating intent to leak, as it has been pointed out here.

If Chamath later told you that he is “fairly” certain that the leak did not come from his team, did he provide a explanation for recanting the assistant to BT to KS line?

Waiting anxiously for your response.

if I was an Airbnb employee, I don’t know how I would feel now..

Chesky’s going to have a tough time facing his employees on Monday…wish I was a fly on the wall in that uncomfortable room.

These founders should not have to apologize to employees. They achieved a billion dollar valuation.

If they’re good people, which I get the feeling they are, The employees will continue to follow.

Chamath seems like a wimp.

Does indeed look like it was written to be leaked..

agree. no reason for him to give elaborate moral advice in a business transaction.

I’ve been working most of today (a Saturday) for a startup, I’ll be working tomorrow, and I’ve been doing this for several months. If I worked at airbnb and I just read that email I’d be stepping outside to enjoy a beer and the sunshine right now. The founders have probably worked hard and may deserve and need some liquidity, but to do it in a way that excludes employees doesn’t sit right to me. Even if an employee was vested and exercised the options (unlikely in a new company) what about all the employees that aren’t? I’d be pissed.

Sounds like Airbnb hasn’t had much positive PR after its initial rise. The way they approach little things is chipping away at their business. Instead, it’s bringing attention to the things a company should never deal with in public

Crunch Fund is already an investor in AirBnb? That was fast.

Does that also mean CrunchFund participated in this type of financing round that Chamath found so objectionable? namely, the owner’s get rich with a HUGE dividend for themselves, but the employees (with no stock but mere stock options) get nothing?

I thought Arrington had a reputation for caring about employees….

@Arrington – What are your thoughts on the content of the email?

He’s an investor which is probably the reason he wrote the article discussing what the VC did and not the content of the “leaked” email. This conflict is the exact reason you cannot report on events when you have an interest in the outcome.

Have the Airbnb guys released any statements about this yet? The only excuse I can think of that they could have for this is to say that they were planning on putting this money back in to the company, but it was for a fairly unconventional use that the investors would be unhappy with, and so they took it out under this guise with the plans of using it for that purpose. But then again, this method doesnt have the investors very happy either…

This is a fiasco for both sides…more for the Airbnb side in my opinion because Chamath’s argumentation is absolutely reasonable. It’s still very surprising since the founders team did a very good job in showing great entrepreneurship in the past months.

I can’t imagine though that it will have any effect on the customer-market.

the same, I am sure most of people has the same feel with you.

I don’t think he leaked it purposely, why would he do that it just looks bad on him and the potential investment? fishy business.

I agree. At first when I thought it was an email just between Chamath and Brian it seemed odd that the email would be written so long and carefully. After I realized Swisher removed the cc line it made more sense. Andreessen and Hoffman were on the email. This was more of a presentation than a one on one communication. Chamath’s story adds up.

Andresson or Hoffman. Could it be that onne of them is a major douche?

I think this was leaked on purpose to shift the balance of power and to end this somewhat silly practice of letting founders cash out significant sums during fairly early investment rounds.

If the founders have already gotten 30m out, how passionate are they going to be moving forward, especially when the going gets tough? You VCs must be going nuts over this trend.

Mr Arrington, even though this comment is not related to this particular post, but I just want to express my fascination with your recent writing. I’ve been reading Techcrunch for a few years, and articles like the ones you’re posting right now and here – were the main reason for me coming back.

Recently, though, on Techcrunch it seems like they’re fewer and farther in between and here, at uncrunched.com, you’ve got the essence of it all (The original thoughts and ideas with fresh perspectives/inside views) without any of the noise.

I mean how awesome is that?! 🙂

I’m with you, and I tweeted to someone that if I had obtained information like this in a clean way I would have posted it too. The only issue here is that the information includes very sensitive stuff about founder finances and was shared to help make an investment decision. Companies may hesitate before sharing this information with Chamath in the future, unless he cleans this up (and it looks like he is).

Well you did, in a way. But with a lot more relevant commentary than what Kara posted. And even though you’re taking a positive stance (It seems so) towards AirBnB and focusing on Chamath, Kudos for even having a take on this story (Conflicts of interest and all that aside)!

The inside view of how these rounds, where founders benefit prematurely, is a net benefit to the community, because they’ll maybe have a thought or two before going the route that Chamath highlighted. It’s a pity that AirBnB will again have to pick up the check, but someone has to make the mistakes for others to learn from.

What do you mean ‘in a clean way’? How does this jibe with your release of the illegally hacked Twitter emails from a couple years ago? Have you changed your tune?

Wait, CrunchFund is still allowed to invest in Airbnb after TC’s brutal slaying several months ago?

Sorry but Chamath Palihapitiya has the moral high ground in my book. He’s got character and integrity. If I need financing one day, I would trust him 100% with my startup’s sensitive information. Let’s not turn this on him, and keep the issue focused on what AirBnb is doing.

I thought that’s what you stood for, Mike: transparency and truth “The TechCrunch way” even if that means offending a few people along the way.

Chamath has shown that he will invest only when he believes it’s a fair deal for everyone related to the transaction. Well done to him. I think honest entrepreneurs will be happy to have him as an investor.

Many seem to mistake principals for principles, but Mr. Palihapitiya does not seem to have this problem.

> Disclosure: CrunchFund is an investor in Airbnb.

You mean:

Disclosure: CrunchFund is an investor in Brian Chesky’s new Ferrari

+1 haha. But definite smart investment, this company is going through the roof. They are the definition of disruption.

I’ve known Chamath for awhile now and he’s a brilliant entrepreneur and businessman. He’d never purposely leak something like this.

+1 kevin. I worked with Chamath at Facebook and he’s an investor in my current company. He would absolutely never violate a confidence like this nor would he play these kind of games. He’s just not that kind of guy. I trust him unreservedly and am lucky he is involved with Copious.

The one thing you figure out about Chamath early on is that he is willing to say it like it is, and I don’t think that would include “leaking” emails. If Chamath wanted to knock on AirBnB he would have just done it publicly and he would have given his reason for doing so.

I agree 100%. As an entrepreneur, your ROI on time spent with Chamath is 10x most VC’s you’ll ever engage. I was fortunate enough to have worked with Chamath in 2007 while he was at Mayfield for a seed round I raised.

The content and essence of his email sent to the airbnb founder is actually a testament to his integrity and value add (most VC’s would send a BS reason for passing) .

Intentionally leaking this email would have either been stupid or ignorant, which clearly Chamath is not.

Take over bid for AirBnB. Starting $ 1000,-

@Morgan Wilde: Well, Arrington WAS TechCrunch, really. Of course there are other great people there, but Mike was the essence. Uncrunched is great, almost as if TechCrunch never went away 😉

Or more like it was reborn 🙂 Which is even better, because you can improve on the basic idea, but do it with a lot of experience from being at it for all these years.

True, true.

You mean THAT was an E-MAIL? I thought it was a blog post. Surely a ‘thanks but no thanks’ would have sufficed.

It depends on your style. I personally prefer to give feedback when somebody asks something of me rather than just say No. Also, it fits with the old adage — if you want money, ask for advice, if you want advice, ask for money. They asked for money and got advice 🙂

Drama aside, this is great advice for any Founder / CEO / Person-In-Charge. What comes of it doesn’t really interest me, but I appreciate the wise words.

Thanks Chamath.

Sometimes the truth hurts. His email seems heartfelt and sincere, like advice from a knowing friend.

Leak aside, the content of the message speaks really well of Chamath: a thoughtful, helpful response that shows an understanding of the link between ethics and good business principles.

It goes without saying that he needs to demonstrate that this kind of leak will never happen again, but what he’s saying makes sense.

I really can’t understand all the hype around Airbnb. As a concept and potential business it aims to solve, Airbnb might sound like a super attractive company with endless potential but I believe the reality will prove it wrong in the future.

I would recommend all investors, which I believe don’t use the service on a daily basis, to give it a try. This is the most inefficient service, which mainly wastes the users’ time.

I tried to use it 3 times and never managed to find any apartment. In one case I sent ~10 messages and received a negative answer from 50% saying that the apartment is not available on that specific dates, although it indicated that it was available on the site. From the other 50%, I never heard a word.

As for the discussed issue itself, that is definitely a problematic issue knowing that emails might leak from such an investor, but I believe that his (Chamath Palihapitiya) opinions and expressed empathetic, which were well explained and described on the email will give him much more points from us, the entrepreneurs.

In response to CC removal, Kara Swisher wrote on Twitter: “It was an error of cut and paste. It is back in.” She later wrote, “Was working from an iPhone quickly as I was out with my kids. Excuse on error in bringing you the email!” Not really sure how that is a copy and paste error, but I’m willing to give her the benefit of the doubt.

This email should endear Chamath to all founders who really care for their employees? He passed on an investment because of a principle that is important – make sure your employees also participate in the goodies.

I’ve never seen anything like that either. The investors put in the capital and it goes out in a dividend? At least if the capital goes to work in the business, it can offset dilution to earlier shareholders. Unless I’m missing something here, how do you get investors to agree to that structure?

Why? Because there is too much dumb money out there right now and founders are following successful models used by Facebook and Groupon to maintain control and cash out larger than normal amounts.

Maybe I’m stupid. I just don’t get the structure. Someone help me out.

“But as I understand the deal, it seems that you are doing only $9.6M in secondary and $22.5M as a dividend to common (of which $21M goes to you and your co-founders)…. … Effectively, it is a strategy that allows you guys to take money out of the business and not dilute yourself “

Scratch that. I found more info. I don’t like it, but I get it. It’s financing 3.0 and I need to get my head around it being I’m still trying to figure out 2.0

I don’t think AirBnb get’s harmed by this at all. The business model is still there. Investors like value, and this startup stills has it. If anything the founder gets (had) a phone call from Reid and/or Andresssen letting him know how a value business is operated. Kudos to Mike for reporting this. He didn’t have to since the story was out, but it shows his commitment to 100% transparency in investing and reporting. This is not only good for the “CrunchFund”, but for Uncrunched.com as well.

I agree in that the core business is still there and I’ll leave it to the experts to argue whether or not the valuation is warranted. This hurts their ability to scale like a billion dollar company.

Someone in the comments said (I paraphrase) “the founders are going to have a rough time facing their employees on Monday”. They well publicised pains to create a fun and nurturing environment but this is the kind of shitstorm no amount of kickball will make right.

An email of this nature with critical financial information and concerns should have been marked ONLY to the AirBnB CEOs and his partners/bosses. If it leaks out from that level, it’s very dangerous. This is not funny from Brian’s point of view. He looks like a grade V student being chided for not doing his homework.

The email was definitely good advice. Since there was a CC list its definitely possible that the leak came from elsewhere.

As for the content, if the AirBNB guys wanna cash out then well thats their choice. If they do we will all hear the groaning afterwards regardless of this email.

Personally, I dont like reading other people’s email but I guess it provides some insight to what goes on, although we knew what goes on already.

This email is kind of like porn. You dont need to look at it unless you have forgotten what naked people having sex looks like.

“The face that the email was between just two people (meaning very low chance of a random leak) ”

Really?

I see a CC line:

“Cc Marc, Reid, my deal team”

oh… just read the update on your post about the CC. I really should check for “updates” at the bottom of posts before I dash off to reply to them…

My money is on Marc. Kara seems to have way too many scoops in every company where he’s involved.

After reading all this, all I can say is, All the best Chamath & AirBnB.

This is a true leak!

I wonder where this post and your last post about brutal honesty #vinodkhosla intersect.

This is extremely sad for those hundreds of employees who give their 200% to the beliefs of their founders and expect honesty and transparency in return. There are enough examples in past when start-ups fell rapidly after their employees stop believing their founders.

You can call me racist, but im not. I simply understand cultures. To work and do deals with Indians is absolutely stupid. They are hard-nosed (negatively), self-interested only, grubbers, backstabbers, and culturally phobic, and never really care about anyone but themselves.

1 % are good – maybe – at least to deal with in business. 99 % may smile and be passive (the HYPER passive-aggressive culture aspect), but are asinine non-interested in positive things.

so you can go on trusting Indians. I’ll work with every other culture. Have fun.

So Chris, if I understand you correctly, an Indian who has principle and conscious to stand up against greed of the founders, who in this case are Brian and his co-founders, are according to you, “hard-nosed (negatively), self-interested only, grubbers, backstabbers, and culturally phobic, and never really care about anyone but themselves.”? Wow.

You need serious help. Go and get some perspective man.

Ring ring….ring ring….

The 16th century called. They want their brain back.

Amazing that in today’s day and age someone can make such a racial comment so openly. And Chris, FYI, I’m guessing you will perhaps include Canada and Sri Lanka to the list of countries where 99% of the people are “asinine”, etc because Crunchbase has the following about Chamath: “Chamath grew up in Canada (born in Sri Lanka)”

http://www.crunchbase.com/person/chamath-palihapitiya

Are there any other countries we need to know about where 99% of the people are pure evil?

This is a racist statement and it seems that you “simply” don’t understand jack.

I love how people always say “i’m not racist” right before saying something really racist.

Why do you suppose they do that? Maybe they don’t actually know what racism is???

Mike,

This was leaked by one of the investors as a way out of the deal. They will use this negative publicity as the main reason for backing out of the deal. The deal is rotten and one of the committed investors is probably having second thoughts.

AirBnB is a bad investment deal all around.

interesting.

Looks like there are some precedents to this kind of strategy. Reminds me of the SEOmoz story: http://pear.ly/f7mOq

Aren’t there easier ways to get out of a deal than trying to hurt the company you invested in? If the person who leaked this ever gets revealed, there won’t be many entrepreneurs who trust them in the future.

As a former employee at several start ups, I can’t tell you how happy it makes me to read an email like this. I’ve been amazed and disappointed by the greed and lack of transparency at these companies. I’ve heard stories of companies and founders that truly care about their employees and making sure that they share the wealth, but never seen any evidence of it. Always seemed to be a collusion of the founders and the VCs to see how much money they could suck out. These practices need to be exposed.

I’m glad someone has a conscious.

I wish this incident didnt happen….as this brings everyone involved in bad light or bad situation.

Even I feel bad that Mike and Kara Swisher published these. Many people wouldnt have known this if you guys didnt publish these. Atleast I wouldnt. No one knows who is the real culprit so really bad to put this out or maybe Kara should disclose the source.

What about the $9.6M secondary? Are employees not able to participate in that?

Why is nobody talking about that part?

It’s a great, strongly principled email. I feel badly for him that it leaked. I’d like to think that good people would still be happy to work with him after seeing this kind of virtuous thought process, but I guess leaky email is an unacceptable mistake.

This is bad. If I was working for airbnb, I will be updating my linkedin profile right now.

Isn’t it true that the startup world has largely disadvantaged the entrepreneur relative to the investors, particularly VCs?

If so, don’t the founders have every right to legally enable their ability to extract some value out of their sweat, tears, and enormous risk they’ve spent their lives on? Especially if the investors who decided to participate in the round have agreed to the terms?

I personally like the fact that founders are gaining more power in the relationship with investors. Whatever is going here, I think AirBnB doesn’t have much to be ashamed about— these 3 founders have taken on much more risk than any early employee. Making this liquidity available to everyone would definitely be a good gesture but certainly not be necessary.

I think Chamath, on the other hand, unfortunately has a lot of work to do to explain himself or at least figure out the leak and post a publicly available explanation… it may be unfair but that is life right?

Founders Risk ain’t the same.

In the old days, founders would mortgage their homes and children’s education fund to finance their dream. The risk today is on poor working American who’s retirement egg is managed by an institutional investor that is an LP in a VC fund.

I’m with you BB, in fact I’m astonished that the founders have the power at this stage (4th round is it?) to do what they are doing. VCs everywhere must be troubled by this revelation.

“Treat your employees the same as you’d treat yourself. Do things that you will be proud of and can defend to anyone including your Board, employees, prospective hires etc. In such a competitive hiring market, you are competing with not just your obvious competitors, but also any successful tech company who is also looking for great talent. A principle that treats your employees as well as you’d treat yourself is a huge strategy for differentiation, retention and long term happiness of the exact types of people you will need to be successful.”

–Chamath Palihapitiya

The above should be printed and put up where every company founder and executive management team can read it every night before they go to sleep.

The world would be a better place for it.

Agreed

Wow – didn’t realize they were such a sketchy company. I thought that issue witht he house robbery was just a fluke.

A billion dollar round! Employees should give their founders a high five and get back to work.

Do some reading around the web. There have been *several* extremely negative instances lately, all of which were well-documented.

The more I read, the more I think Dave (above) is correct: someone leaked this specifically to get out of the deal. AirBNB is having serious issues right now, and many investors may want to shy away from the company until they can figure out how to get their shit straight.

It is obvious to me that the leak was not intentional. But most striking to me is the level of integrity Chamath exhibits in his e-mail.

@Mike

Honest question: If this email was leaked to you yesterday, would you have gone on to publish this? I think this email clearly puts airbnb in a poor light, which doesn’t do any favors for the company you’ve invested $ into. Because it was leaked by Kara you have no choice but to run with it. Again, not a knock against you, just an question that came to mind when reading your take on the situation.

Chamath Palihapitiya comes out of this very well – clearly a man with integrity, if I did a startup I’d definitely want someone like this rather than say crunchfund. Yet again it seems Arrington is torn between being a blogger/journalist and protecting and positioning his investments in best possible light. I’m surprised he can’t see this.

AirBnB – I feel sorry for the employees, that is a hell of a lot of liquidity for the founders to “need”. I prefer the Zappos, Benioff type founder.

“I prefer Zappos, Benioff type founder”

AirBnb created more value than Hsieh and took less off the table. Zappos sold for 900 million and they sold for a billion.

The quicker and easier than selling on secondary markets..and enables the founders to get back to work.

So I agree this is a mess for all involved; let’s just accept that many smart comments have been made about that. But have we lost the forest for the trees?

Should we maybe talk more about whether it’s in anyway a good idea for founders to be taking $10 million of liquidity from the company at this stage and how that screws up incentives? I mean who cares about the mechanics, it just seems like people who already have that kind of money from the deal are not going to be as hungry and aggressive as, well, those who don’t. Call me old school, but this seems like the much larger issue.

I like Chamath point of view from where he sits and makes sense (especially that he is all for investors who bring value should be considered for “control”), however you have to respect the founders of AirBnB to create a “strategic round” that provides:

– Operational cash for hyper growth – Job #1

– Provides little bit of liquidity without giving control – will motivate their founders, empoyees, consultants, early investors such that they are creating a market. Job # 2. we all know, we need motivated team to provide hyper growth and protect from high networth tech companies (you all know who i am talking about) and others to take away your home grown talent … so, you take care of your team that brought you here …

– Neutralizing the risk for early stakeholders – believe me, everyone wins

– enforcing an organic and potential inorganic growth plan at this stage of a startup – brilliant move by whoever suggested this plan of financing

– Shows that this management team will take care of stakeholders as they are already illustrating that in their young careers (Fortue 1000 CEOs and management can learn from this as not every F1000 that i dealth with had stakeholders value maximze or optimize).

– Attracts new serious investors who are inclined to post 30%+ IRR – they know what they are buying … truth is that they will most likely get better than 30%+ IRR based on the moves of the current management – my hats to their genuious who was the architect of this plan – more startups that are premoney valuation of $ 500M and above and can sustain should do this …

Dipak

Dipak.Shah@reliantaudit.com

“A few million dollars are won and lost in the sands of time.”

Not sure what the big deal is. I would be much more uncomfortable today if my company’s Founders did not take some money off the table in a billion dollar round.

Groupon does not suck because they took some money off the table. They suck because their CEO is a douche.

A billion! who gives a shit about 20million.

If you were an employee of that company, getting underpaid with stock options, you’d be pretty upset for the long hours you put into work.

The content of Palihapitiya’s e-mail is right on target. I would hope that CrunchFund agrees and also voiced concern, as it would be a shame for this practice to become common.

A big part of the problem is that…well, it was an e-mail. Not really an appropriate topic for e-mail.

More at: http://bit.ly/oBp3nR

I don’t know the guy, but I read that email; If you think you can trust the person who wrote that email, you should read it again.

Saying “don’t piss on the little people” doesn’t make you a good guy.

I think AirBnB needs to change their name. Something like VRBO, expedia, travelocity etc. I don’t see any airbeds on the site and barely and B&Bs