Venture firms have been buying stock on secondary markets in quasi-public companies for some time. This means they’re buying stock from other stockholders, not investing money into the company. They’re doing it because they think the stock is cheap and there are still venture level returns to be made. And they’re also doing it for marketing purposes, to put the cherished company logo up on their website as a portfolio investment.

Elevation Partners bet the house on a massive Facebook secondary market transaction in 2010, for example (it was a good bet). Facebook is listed as a portfolio investment on the Elevation site.

Andreessen Horowitz also does this – their investments in both Facebook and Twitter were both secondary market transactions. Both companies are listed prominently on their portfolio page.

Kleiner Perkins also lists Facebook as an investment on it’s Digital Growth Fund page, although it takes a bunch of clicks to get there. Their main portfolio page does not list Facebook. The firm bought shares in the secondary market.

Competitor venture capitalists hate this – a portfolio page listing a Facebook investment could mean a late stage secondary deal made without the knowledge of Facebook, or it could mean a very early investment at a $100 million valuation (Accel, in that case) when everyone thought you were crazy for putting money behind a Harvard dropout.

Sarah Lacy wrote a post on TechCrunch earlier this year (with a really handy chart) showing which firms invested in which companies when and at what valuations. It really shows how much of a difference there is.

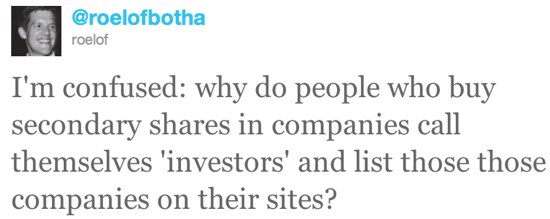

This is inside baseball, but most of the really interesting stuff is inside baseball, in my opinion. So when you see Roelof Botha at Sequoia Capital talking about the issue publicly on Twitter (see image above), that’s what’s really going on. Marketing, positioning, and future deal flow. As well as genuine frustration about what the ground rules are for VCs.

Disclosure – every venture firm mentioned in this post (or their individual partners), except Elevation Partners, is an investor in CrunchFund. I keep meaning to put up a website showing all of their logos.

hahaha add Gridjot! Get us before Roelof does.

I hate it when anyone in general pretends to be someone they’re not. Authenticity is so important.

better to invest on ijunkey com and be owner of tech site

2nd highest i have ever been

Better invest here https://flippa.com/2643230-ijunkey-technology-specialist-with-lots-of-tutorials-and-fixes-iphone-ipad

I often find myself wondering who actually invested in FB, Twitter, Foursquare…and when. It’s come to the point where it seems irrelevant to pay attention anymore unless they invested in seed or series A. Those are the real visionaries/winners you want to be doing business with.

Check the crunchbase. A lot of the information you are looking for is in there.

LOL, I’ve actually thought about being shares on Secondmarket to spice up the Investments page of my fledgling incubator.

Yep, check CrunchBase.

Although VCs that want the prestige of being notable early investors could just add that info to their Portfolio page.

e.g. Foursquare – Series A, Facebook – Series B, C, Xynga – Seed, Series A.

It may be “inside baseball”, but the devil is in the details, to mix metaphors.

maybe, because, ALL people who INVEST money in a company can be called “INVESTORS”

by that definition every trader is an ‘investor’ in Google???

well, I’ve missed a word: … INVEST [his] money …

‘[his]’? the source of the money is irrelevant, it’s about investing money into the company rather into an employees pocket (buying shares off an employee doesn’t go into the company).

but still, yes all people who invest money IN a company should be called INVESTORS, whereas others should be called shareholders. adding [his] just makes u look foolish when you was ok before

I own stock in a lot of top-notch companies (Apple, FedEx, etc.). Does this mean that I can put their logos on my personal web site and claim “investor” status? Technically, yes, but practically, not really. Any VC that buys stock on the secondary market and claims they are an “investor” (implying the same risk, foresight and intelligence that the _real_ initial investors demonstrated) is falsifying their claim.

My BS antenna goes way up when I see crap like this.

I tend to agree, but technically I could see how these firms justify adding Facebook to their portfolios. Their websites aren’t just for entrepreneurs – they are also to attract limited partners. They want their LPs to know they are invested in Facebook. Anyway, I think smart firms will ‘note’ the difference between the companies they contribute capital/expertise to and those they bought on the secondary market.

Fascinating – I love these candid inside glances. Keep them coming!

Roelof makes a valid point. I appreciate the way Aydin Senkut at Felicis Ventures handles it by listing his firm’s direct investments and calling Felicis’ ownership in Groupon, Twitter and Facebook as “Other Holdings”. This is an authentic approach.

One potential definition: if the CEO will directly return your email the same day, you count as a VC investor.

Well, showboating is nothing new. Folks glorifying wins and avoiding losses. Do your homework.

Zschau is spot on. Be transparent and disclose it as an ‘Other Holding.’ You might as well because folks will dig the right answer later.

This points to a more fundamental problem with the stock market itself and the difference between actual investment in a company (or an idea) and “investing” in the market where you are betting (basically albeit with some degree less “luck” involved) that your view of the future of a given company will be both accurate and shared by other investors.

However buying shares from other shareholders (whether via a public market or via a private secondary market) does little to benefit the underlying company. The price established for the shares may in often a very limited way help that company with some future acquisitions (both of individual employees and entire companies) but this may even be offset a bit by diminished retention of some employees (if stock option grants appear to have little likelihood of ever being very valuable many employees may start looking for “better” opportunities)

All too often we read about how going public via an IPO is the end goal – but once public (or once widely traded via an active secondary market) I think what gets lost is how little of that capital changing hands is actually made available to the company to fund future growth and capital investments. The focus on the stock markets also often miss the frequently far more meaningful for many companies role of the bond markets (both long term and short term “paper”) which is perhaps the real reason many companies want to be public firms – to have greater access to these very large scale and relatively low cost sources of actual capital for a company to fund growth and operations.

I agree that it would be hugely beneficial for entrepreneurs (and frankly everyone in the ecosystem) if the difference between investments that resulted in funds for the business and “investments” which were the result of purchases via secondary markets was made very clear.

For that matter it would also be useful to differentiate the portion of a funding round which goes to earlier shareholders (including employees and company founders) and that portion which is actual new money into the business. The recent round into Dropbox appears notable for being both very large and for not (if stories are accurate) including any buying out of existing shareholders or sales by company insiders as part of this very large round. Thus it actually does represent a very large injection of capital to a growing business vs some other similarly large “rounds” where half or more the round may have gone to existing shareholders and not the company.

Mind if I invest a bit in CrunchFund and list all those other funds as business partners? I could fill up the whole back of my business card with their logos. : )

This type of secondary buyer is commonly referred to as a “speculator.” They are simply buying stock from one person and speculating the value will go up.

Mike this is sort of a meta thing you mention at the end. Venture firms investing in crunchfund which invests in startups. What happens when crunchfund and one of these venture firms “compete” to get a slot in a round of financing in a new startup? Is that become an issue???

I’ve invested my money and client’s money on Facebook Ads so therefore, I’ve “invested in Facebook,” right? I can’t wait to tell my friends!

The Valley is teaming with Chuds…

and teeming too…

I’m seing so many startups these last years… feels like 1998. When are we going to start seeing the massive IPO’s. Which startups will be the new pets.com, toys.com, mothernature.com, etc?

What are your thoughts on a VC including a company in their portfolio even if they only became one by accepting stock in a sale of one of their portfolio companies?

I mean, in some ways, that is really not the same thing as investing cold hard cash in a company, either, no?

Welcome your thoughts,

Ash

I don’t see why buying shares in a company should not qualify as being an investor. They saw the value after earlier backers and they paid a very high price for it.

It is not clear either that their risk-adjusted return is any lower than earlier backers.

Tito – the point is that if an “investor” is buying shares from other shareholders (not from the company) then they are betting and may make a return on their money – but they are NOT investing IN the company as none of their money will go to the company to further that company’s business goals.

i.e. to use a non-stock example. An artist puts up a project proposal to Kickstarter offering the early backers limited edition prints of the resulting planned work (perhaps even offering the original work for a very large backer – i.e. pre-selling it). If those early backers turn around and sell those limited editions to another collector they may “make” money and that collector may “invest” in the work with the expectation that the work will increase in value. But that transaction will not directly benefit the artist.

If the artist retained some of those limited editions and were to sell them on the open market then possibly the “price” that such secondary market sales have created will impact the price the artist could get (i.e. secondary market sales of a stock may define the “value” of the company and stock which the company may sell in the future). This might also be the case if instead of selling a work the artist were to barter the work for say future services or partnership with another party (i.e. if the company were to try to use stock grants to compensate employees or to buy a company then the price set via secondary markets may impact how those shares are valued)

But there is a big difference if you are looking at VC’s between those who invest IN the company and those who use access to secondary markets to bet on the company. Yes early stage (or any stage) investments are also a type of “bet” but they are also a direct relationship with the company – often including obligations from the investor such as serving on the board (and often having more complex agreements with the company than a simple common stock owner has)

The return an “investor” makes for their limited partners and backers isn’t how an entrepreneur or company looking for investors should be evaluating VCs. As a company founder I do not care about the return a VC who invests in me has made in the past for his (or her) limited partners – I care far more about the relationship, her track record of supporting her companies and her (or his) long term track record with other entrepreneurs and companies (i.e. investors who have a history of supporting entrepreneurs and of helping to build great companies are of more interest to me than investors with a history of forcing founders out and taking short term steps to try to quickly flip companies or make what they think will be maximal returns)

Thank you very much for the insight. Sarah’s post is a perfect complement. I needed this.

I’ll take some Facebook stock right now if you have it. heh!

– Kyle Dziedzina