I’m fascinated by startups that remove inefficiencies from real world tasks. Abacus, one of our newest investments, does exactly this. But most people don’t quite understand why yet.

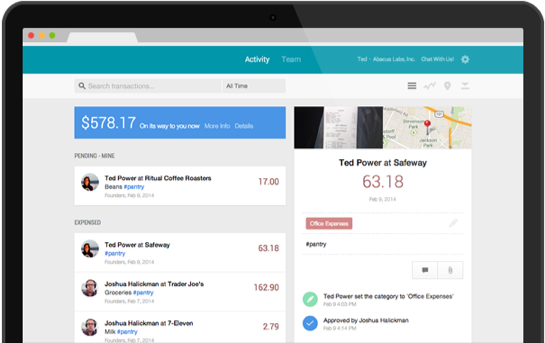

At first glance it’s just another useful app for streamlining business expenses. TechCrunch did a good overview of the service when it first launched a couple of months ago, but I don’t think they quite captured the essence of what Abacus is doing.

There are a whole class of “software-meets-reality” startups today that are successful because they remove pain from a real world activity. Sometimes people didn’t even quite know that the pain was there.

Uber is a perfect example. After using it for the first time people realize that it isn’t really about the nice cars. It’s about getting a car whenever and wherever you need it. That’s a service that taxis are supposed to provide, but they don’t. Anyone who has stood endlessly on a street corner waiting for a taxi, or who scheduled one for a ride to the airport but it never bothered to come, understands this. Uber fixes the taxi mess and makes life more enjoyable.

I’m not going to say that Abacus is the uber-for-expenses because it isn’t. But I apply the same thinking towards analyzing what Abacus does as I did when we invested in Uber.

First, like other apps Abacus makes it a lot easier on the user to keep track of business expenses. Take a picture of a receipt or let it interact with your email and you’re basically done.

The key differentiator with Abacus, though, is that it takes a (very painful) batch process of dealing with employee business expenses and removes pain at almost every point along the way.

Here’s how the old expense system works:

1. Employees gather expenses and file reports periodically to the company.

2. The company goes through an approval process, enters reports into accounting software and then either cuts physical checks or integrates into payroll. They need software for all of this, and more software for communicating with employees. lots of back office employee time is spent dealing with all of this.

3. Employees get paid eventually, but it may be 60+ days after the expense.

4. That means employees have to float the expense for a long time on their credit cards. If they can’t handle the delay they have to do things like borrow the company Amex to pay for bigger expenses, which adds further complexity to they system.

Here’s how Abacus works, eliminating pain and busy work along the way:

1. Employees use the app to get expenses into the system as they incur them.

2. A manager uses the app to approve expenses immediately (or every few days, whatever they want).

3. Abacus auto-syncs with the companies accounting software, makes a same day auto-payment to the employee’s bank account, and handles all communication with the employee.

Again, I want to highlight that the main feature here isn’t “taking pictures of receipts.” It’s about eliminating the need for employees to float expenses for weeks or months, and about removing a ton of back office manual process pain while doing it.

That means a company looking at Abacus is going to see a lot of happy and want it immediately. The fact that it’s very reasonably priced makes that decision even easier.

Not only did we invest in Abacus, we’re going to use it ourselves at CrunchFund and recommending all of our portfolio companies take a look. Once a startup has even a few employees, Abacus makes a lot of sense.

Big hopes for this one.

“The data center is broken, and we fixed it, like Google. Developers will never have to worry about scaling issues again.”

“The data center is broken, and we fixed it, like Google. Developers will never have to worry about scaling issues again.”