How much is the loss of key female talent costing your organization, Arianna? This much.

Monthly Archives: December 2011

Pacman Frog

He’s about as good as most tech writers at reviewing a phone, so why not.

If We Play By Big Government Rules, We’ve Lost

I’ve been following the developments around the Stop Online Piracy Act (SOPA) making its way through Congress with the same trepidation that I’ve followed previous governmental tech blunders, wondering if this time they’ll piss in the flowerbed enough to kill all the flowers.

I’ve been following the developments around the Stop Online Piracy Act (SOPA) making its way through Congress with the same trepidation that I’ve followed previous governmental tech blunders, wondering if this time they’ll piss in the flowerbed enough to kill all the flowers.

I was very happy to see Joshua Kopstein’s Dear Congress, It’s No Longer OK To Not Know How The Internet Works post last week calling out congress as a whole, and individual elected officials, on their ridiculous tendency to use their tech ignorance as some sort of badge of honor. The facts don’t matter, they seem to almost be literally saying. The unspoken words are, all that matters is the money, which flows from Hollywood. Protect the IP, no matter what the cost.

Today though Clay Johnson writes a rebuttal to Kopstein’s post, saying the opposite – Dear Internet: It’s No Longer OK to Not Know How Congress Works.

His argument is that Silicon Valley has to start playing by the rules if they expect to get what they want from our government. It’s a balanced argument, not simply pro-government. But I think it sparks a dangerous idea – that we need to play ball or else.

It’s the libertarian in me (or the fact that I’ve been mesmerized by Starz show Boss these last few months), but all I see in Washington DC are a bunch of elected thugs with various overlapping crime rings beneath them. Their job is to get reelected and gain power, not help the country or do what’s right. Unless you have a lot of money and are willing to spend it lobbying, you’re going to lose your fight no matter how righteous your position.

In Johnson’s world, congress gives a damn: “The truth is that Congress would much rather listen to its constituents than listen to lobbyists,” he says. Maybe he’s right, but I’ve yet to meet an elected official or bureaucrat who actually gave a damn. The profession just seems to attract a certain type of person, and that person wants to talk to the money, not to the people.

I’m not naive enough to think that will change any time soon. But I do hope that Silicon Valley doesn’t just give up and start playing the game, like Johnson suggests.

To some extent we already do play the game, of course. Companies banded together in the 90’s to push the government to rip apart Microsoft. Microsoft and Facebook do the same thing today with Google, and Google’s no slouch in the political arena itself.

But the young startups, the ones trying revolutionary new things that are often messy and usually piss off some big profitable industry. Those are the ones that can’t play the game and expect to survive. Startups must be nimble. They can’t spend time mucking around as some sort of coalition and trying to lobby and pay off the government. Nor can they spend the time educating our congress about how the Internet actually works.

Instead, they just build. Disrupt. Fail. Succeed.

I still believe what I wrote in June 2010, and I’ll still believe it in another ten years.

Silicon Valley has fueled much of the growth in our economy over the last few decades and has created amazing (and highly profitable) companies that are making the world a much better and more interesting place to live. All that happened while the government ignored us.

We don’t want handouts. We don’t want “public-private partnerships,” and we sure as hell don’t want legislation. Just let us do our thing and maybe say thanks to those companies that create jobs by the hundreds of thousands and send in those humongous corporate tax payments on profits. Because all you can do is screw up something beautiful. Really.

This is a special place (the tech world). Leave it alone and let it thrive. If we continue to ignore the huge value destroying game played in Washington DC we may continue to get hit hard over and over again. But if we start playing the game – as Johnson suggests – then a lot of what’s special about Silicon Valley will just vaporize away.

The Internet has already adapted. It’s time for Congress to do the same.

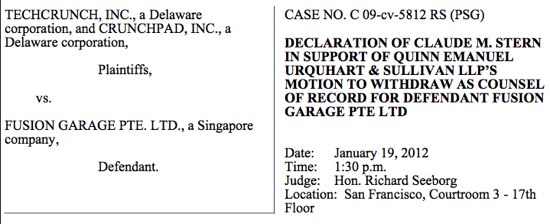

Fusion Garage Fired By Its Lawyers

News broke yesterday that Fusion Garage was fired by its PR firm, its website is offline and customers are pissed off that they haven’t received their orders. This is the company that we worked with for a year on the CrunchPad project, and eventually defrauded us.

Here’s more – the law firm representing Fusion Garage in the lawsuit with us (well, now it’s with Aol), Quinn Emanuel, has requested permission from the court to withdraw as counsel. From the filing on December 13:

2. Quinn Emanuel seeks leave to withdraw as counsel of record for Defendant Fusion Garage PTE. Ltd. (“Fusion Garage”) because Fusion Garage’s non-payment of attorneys’ fees and associated costs and a breakdown of the attorney-client relationship have made it unreasonably difficult, if not impossible, for Quinn Emanuel to continue to adequately and properly represent Fusion Garage in this matter.

3. Fusion Garage has not paid Quinn Emanuel for services rendered and the costs associated with those services for several months. During that time, Quinn Emanuel has acted on behalf of Fusion Garage by seeking discovery from Plaintiffs, responding to written discovery propounded by Plaintiffs, conducting third party discovery (including a deposition of Keith Teare), engaging in lengthy and protracted settlement negotiations, and preparing a motion to compel that is scheduled to be heard on January 3, 2012, among other tasks that cannot be disclosed on grounds of privilege and work product.

4. Fusion Garage and Quinn Emanuel have had a breakdown in communication that Quinn Emanuel can more fully explain to the Court in camera if requested by the Court. The circumstances have placed Quinn Emanuel in a position where it can no longer provide effective representation to Fusion Garage.

5. On numerous occasions (at least on November 25, 2011, December 1, 2011, December 2, 2011, December 8, 2011, and December 12, 2011), I informed Fusion Garage either orally or in writing that Quinn Emanuel would resign as counsel for Fusion Garage and would seek leave of court to withdraw from this case, and that Fusion Garage needed to retain new counsel.

Fusion Garage finally destroying itself certainly makes me happy. The fact that Quinn Emanuel and PR firm McGrath Power, who advised Fusion Garage on the right way to execute on the fraud, are left with unpaid bills also makes me happy. I’m sorry to the customers who tried to pre-order these things and may never see their money again. But, really, what were you thinking?

I’ll write more about this later, and how this failed relationship fundamentally changed my thinking on business partnerships. But for now, just die Fusion Garage. And slink away in shame, because it sure doesn’t look like you’re going to end this the honorable way.

Why Heather Matters

TechCrunch CEO Heather Harde announced her departure today.

I’m so angry.

Drift back to the end of 2006. TechCrunch was a year and a half old. My hobby had turned into a business. Federated Media was selling our standard ads and sent a small check every month. Nik Cubrilovic had “invented” the notion of a 125 pixel square ad that we’d sell for a flat rate, which was an unqualified success and was quickly copied by everyone else. We had enough money to have a staff, and things were looking pretty good.

But we had a massive hole in the organization. There was no sales team, and no one to handle all the important parts of a business. I began to recruit Heather Harde, an executive at Fox, to fill that hole. It took months before she agreed, but in March 2007 she was on board.

Heather was a perfect fit at TechCrunch. She’s dogged and ambitious and willing to take massively risky bets when it makes sense. She’s also the most even tempered, thoughtful person I know personally. Think Dalai Lama calm, even in the face of my monthly “the sky is falling” proclamations. No matter how messy things got, Heather just kept on marching, and everyone followed.

What I did right, and this is important, is I hired Heather to be my boss. That gave her the authority she needed to run the company. A lot of our competitors seemed more ego driven, with the blogger demanding to stay CEO. That meant they hired less awesome people, and then those people didn’t have the room to maneuver. As a result, we grew much more quickly than they did.

Revenue was marginal when she joined, maybe $500,000 in 2006. By the time we sold TechCrunch revenue was $10 million a year. And this last year under Aol Heather grew revenue by another 50% or, based on what I’ve seen reported.

Other than dial up, TechCrunch is/was the most profitable and fastest growing business unit inside of Aol.

That, ultimately, is why everything fell apart.

When I jointly announced CrunchFund with Aol a few months ago, everything was humming at TechCrunch. The core writing and business team was intact nearly a year after the acquisition, no small accomplishment. We were crushing our competition. Not just beating them but actually dominating the tech news space.

TechCrunch continued to get so much attention that, I later understood, it chafed Arianna Huffington. Even though TechCrunch reported to her, in her eyes any attention TechCrunch got was just less attention for her.

This became a turf war between me and Arianna Huffington, although I had no idea that there was a war going on until I’d lost it. Arianna made her classic political power move by publicly terminating me without approval or knowledge from Aol, and despite the fact that she’d already approved the CrunchFund announcement. My counter was to just blow the whole situation up and create chaos.

But I was also trying to carve TechCrunch away from Huffington Post via endless conversations with Aol. Give us the freedom to operate on our own, I begged, or sell TechCrunch back to us.

It seemed an easy thing to do. Aol’s multiple conflicting press statements left little doubt that things were a mess. But Aol, above all else, wanted to save face for Arianna. There would be no independence from HuffPo because Arianna would be upset. And TechCrunch was growing too fast, and was too profitable, to sell.

In other words, it makes perfect business sense to sacrifice TechCrunch and let it fall apart. The company has bet everything on Huffington, so anything that challenges her power, real or perceived, has to be destroyed.

If only Heather had slacked off that last year, and tanked the business. If that had happened, TechCrunch would almost certainly be independent and thriving today.

So it never happened. I “decided to move on“. Paul Carr resigned shortly afterward, and was knifed on the way out.

Then MG Siegler left to join me at CrunchFund. Heather and I (now as an outsider) worked hard to keep him at TechCrunch writing full time. But if he’d done that Huffington’s “principled” position on terminating me – that I was now an investor and could’t therefore write blog posts – no longer held water. So he was shuffled to the background, and TechCrunch lost the best tech writer on the planet. Siegler continues to write amazing content on his personal blog. All of that would be on TechCrunch, but for Arianna.

Then Sarah Lacy resigned in a hastily written blog post, afraid her credentials would be turned off like Carr’s were. How ridiculous that the people who built the site were, in the end, forced to run out the back door to preserve some dignity. I spent the last week before she resigned trying to find a way to keep her at TechCrunch.

And now Heather, who for some crazy reason stayed on at TechCrunch, dealing with constant verbal abuse from HuffPo execs (they refer to her by the “c” word over at HuffPo), just because it was the right thing to do.

It’s insane. She could do any job at AOL better than the person currently doing it. She should have been embraced and treasured. But Arianna had to…save face. So today Aol loses one of the only executives left in the company who actually knows how to run a business, profitably. I’d trade 100 Arianna’s for a Heather any day.

The body count at Aol is rising, and too many of these people were casualties of Arianna’s ego. Jon Brod was kicked to the curb for disagreeing with her about how to run the Huffington Post business. Brad Garlinghouse fell out of favor at least partially because he was the only one willing to call bullshit on her power grabs. And there are others.

Aol needs to decide whether it exists for the benefit of stockholders, users and employees, or whether it exists for the greater glorification of Arianna Huffington. She’s waging this political power war inside of Aol against anyone who stands “against” her. But no one’s fighting back because that’s not how they see the world. Instead they just drift off, to create real value at other companies who actually value them.

I’m still a shareholder in Aol (I bought stock earlier this year). I still believe that Tim Armstrong will figure this out and save the day. But the damage keeps piling up. It’s time to lead.

Photo Credit: Scott Beale

Hate Your Jawbone Up? Trade It In For A Free Lark Vibrating Alarm

A lot of Jawbone Up users aren’t happy with their devices. There are so many issues, in fact, that the company is giving people a full refund for the device, no questions asked, and they can even keep the Up. The device is no longer for sale, but we can expect it back soon (I, for one, continue to use mine daily).

A lot of Jawbone Up users aren’t happy with their devices. There are so many issues, in fact, that the company is giving people a full refund for the device, no questions asked, and they can even keep the Up. The device is no longer for sale, but we can expect it back soon (I, for one, continue to use mine daily).

Lark, a competitor of the Up, is taking this opportunity to introduce Up users to their device, for free. Like the Up, Lark wakes you up with a silent vibrating wristband (it works, really well). Unlike the Up, Lark is completely focused on sleep health. Their app tells you how well you slept each night and gives helpful hints about improving your sleep. There’s a good review of the device here, and reviews on Apple are strong.

The Up also has an excellent pedometer and a way to track calories, so the two devices don’t overlap completely. But for people who are sick of their Up, they can now trade it in for a free Lark device, shipping included. Not bad for a device that sells at Apple stores for $100.

Details are here. All you have to do is ship your Up device to Lark and they’ll then send you a Lark device. There’s no limit to the number of devices Lark will send out, but if they’re overwhelmed they may eventually shut down the offer. So if you want to do this, do it fast.

As far as I can tell, the Up guarantee doesn’t preclude sending your device in to Lark even if you take the full refund. So you can get your money back from Jawbone and still get the Lark for free. Not a bad deal at all. And, yes, Lark says they’ll deliver the devices by Christmas if you trade in soon.

Full disclosure – Lark launched at a TechCrunch Disrupt event and is a portfolio company of CrunchFund. I continue to use, and love, both the Lark and the Up.

AOL Looking For New HuffPo Media Group President

Here’s an interesting tidbit about Aol that’s being whispered around Silicon Valley – Aol is working with recruiting behemoth Spencer Stuart to hire a new business lead for the Huffington Post Media Group. The executive will report to Aol CEO Tim Armstrong, apparently, not Huffington.

Currently Arianna Huffington runs both the business and editorial sides of the group. Running a business is fairly new to her. Before the Aol Acquisition Eric Hippeau was the CEO, but he resigned just before the Aol deal was closed.

Aol exec Jon Brod ran the business after the acquisition, as COO of the group. But a dispute with Huffington led to a reassignment for Brod, who currently runs Patch at Aol.

By far the most interesting part of all this, though, is it’s not clear that Arianna Huffington is aware that the new position will report to Tim Armstrong, not Huffington.

Whatever happens, I’m pretty sure I won’t be getting my old job back.

Gowalla Founders v. Gowalla Investors

Location based service Gowalla is going to shut down at the end of January. The two founders, Josh Williams and Scott Raymond, will be heading off to Facebook. Loyal Gowalla users will be stranded as the service shuts down. And some of the investors have told me that they’re pretty angry over the whole thing.

Location based service Gowalla is going to shut down at the end of January. The two founders, Josh Williams and Scott Raymond, will be heading off to Facebook. Loyal Gowalla users will be stranded as the service shuts down. And some of the investors have told me that they’re pretty angry over the whole thing.

Is it an acquisition? Or rather a shutdown with the founders taking new jobs?

There’s no clear answer to that. Williams’ blog post is intentionally vague on that point. An email sent to investors, though, suggests that some kind of deal between the companies is happening.

Some investors seem to know the terms of the deal – they’ll be getting twenty or thirty cents back for every dollar invested (the company has raised a little more than $10 million). But most of the investors I spoke with had no idea what was going on, and what if anything they’d be receiving back for their dollars in.

This is a tricky topic for me to write about, since I’m now an investor. But in 2010 I dove into the topic, noting a trend of startups being acquired for not much money, but founders and key employees were being given rich stock deals on the side.

This goes way back to Parakey, acquired by Facebook in 2007. Parakey investors got their money back and a little more, but stock grants were given to the founders that are probably worth hundreds of millions of dollars today.

I was more blunt in 2010 when Facebook acquired Hot Potato – and noted that there’s a real issue of breach of fiduciary duty when a founder takes a side deal but doesn’t cut investors in.

Two Ways To Look At This

When a startup gets acquired in this way – where investors get very little compensation and founders get a whole lot of compensation – it can be seen in two ways.

The first way is this: Investors see themselves as being taken advantage of, providing capital for founders to essentially buff up their resume to get their dream job. When a company is acquired, they say, the value of stock grants should be considered acquisition value and divided up among all stockholders. If a founder leaves stockholders behind to take a lucrative side deal, they’re not acting ethically. I’ve mostly taken this position in the past, before becoming a VC.

But there’s another way to look at this, too. Some investors, particularly Ron Conway and David Lee at SV Angel, have told me for years that they aren’t bothered by these types of deals. The argument is that the company (whatever company was being acquired at the time) was clearly not going anywhere and would eventually shut down, so who cares if the founders cut themselves a nice deal going forward. The investment was already a write-off. Investors in this group tend to focus their attention on the winners in their portfolio, the companies that will eventually provide a 10x – 1000x return. There’s little chance the founders will bail out in those companies to take middle management positions at Facebook, they say.

In this case, Gowalla was a goner anyway, so there’s no real harm done with the pennies-on-the-dollar acquisition. Clearly the founders could have communicated a little more effectively to investors, rather than just thank them in the blog post for “playing a special role in seeing us to this day.” That feels like gloating and condescension, said one investor.

Also, Facebook and other companies doing these deals aren’t to blame. They want the employees and not the other assets, and they’re doing deals that make sense to them. It’s not their job to protect the shareholder rights of the companies they’re acquiring.

These deals will continue to happen, and investors will continue to be frustrated. But there’s very little they can really do to fight it without looking anti-entrepreneur. And I mostly agree that there isn’t anything to really fix, anyway, given that these startups were all on life support.

Focus on the winners, and don’t lose sleep over the losers. Seems like a good investment philosophy to me. And yes, I’d probably want to invest in Josh Williams and Scott Raymond the next time they start a company. They fought long and hard for a win. Next time they may get there.