An addendum to my notes from yesterday.

One of the big talking points for people is the notion that the Republicans want to “sharply cut social services for the poor to pay for huge tax cuts for the rich.”

This talking point really works, because everyone knows the Republicans want to rework entitlements and they don’t like raising taxes on the rich. People get really pissed thinking about it. Rich people want a new ferrari or something, so some dirt poor family has to go without shoes.

But anyone who says this is either completely misinformed or (worse) dishonest. Most of my friends here in San Francisco are one of these.

And this is the kind of dishonesty that is really going to make the final reckoning a

whole lot more painful.

Because it doesn’t matter how much you tax the rich. At some point this country is going to have to deal with the unfunded entitlement obligations that are going to crush us. That are already crushing us.

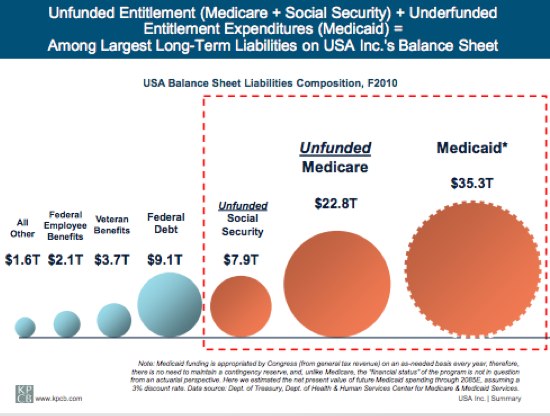

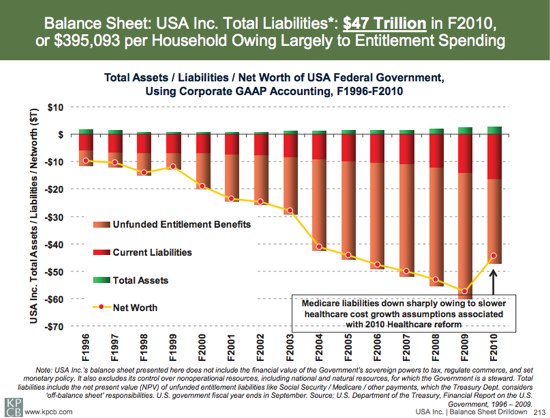

At some point we’re going to have to find some $47 Trillion dollars to pay for exploding Medicare and Medicaid obligations.

That’s not going to happen. The government will either create massive inflation to deal with this, or entitlements will be rewritten and gutted.

Either way everyone is going to get crushed.

If you don’t understand this but you continue to throw out ridiculous statements like Romney believes in “sharply cutting social services for the poor to pay for huge tax cuts for the rich” you’re part of the problem.

As I’ve said before, go for it! Destroy the rich. Take it all. But when you’re done, someone’s going to have to deal with the financial mess we’re in. Because destroying the rich will do absolutely nothing to fix this problem.

The problem is so big that we’re not going to deal with it no matter who wins this election because U.S. citizens don’t yet understand how hard things are going to get down the road. My guess is in another 5 years or so the shit will really hit the fan and everything will change.

But in the meantime, if you’re going to throw out righteous opinions, at least take the time to understand exactly what the problem is.

Mike, it’s great to see that there are other like-minded people in San Francisco when it comes to politics. You should have a political discussion day at The Creamery 😛

I would absolutely be up for this.

I’m not sure why you don’t think this is a problem: “Rich people want a new ferrari or something, so some dirt poor family has to go without shoes.”

You can take it a step forward: Rich people want a new ferrari or something, so 10,000 dirt poor family has to go without shoes.

The point is that the inequality gap is a major problem because rich people do not consume like the multiple of less rich people they represent. Warren Buffett eats 3 meals a day, not 30,000. Bill Gates buys one car every 5 years, not 50,000. Consumer spending has been completely eroded because all the money flows to rich people and corporations who don’t spend it.

no. all of it, no.

You’re right, you’re completely right. Only most of it flows to a very small group at the top. That’s not all, sure.

You’re right that the big long-term question is how do we significantly lower or eliminate the debt. Reasonable people agree this should include slowing the growth in entitlements and raising taxes.

But when you get to the question of how exactly you will restructure entitlements and how you will raise taxes, then the question of politicians’ priorities becomes important: for instance, you could do that in a more progressive way by making smaller cuts to Medicare benefits for the middle class than for the wealthy.

So it’s legitimate to criticize the Romney/Ryan perspective and say we should go with a more progressive long-term budget fix that will shore up the middle class–instead of letting the US become like an old-school banana republic filled with lots of rich and tons of poor people.

Exactly. The COMBINED wealth of the Forbes 400 – if we taxed their income at 100% AND just decided to raid their bank accounts…. ~$1.6 trillion. Read that again… one-point-six… and then scroll up to the pie charts. Looks like taxing the rich is a perfect solution for…… the tiniest “All Other” pie.

By that virtue, do the super rich use 10,000 times as many government resources? Probably not.

Absolutely, yes. Every war since WWII is fought solely for them- and fought BY the poor who give their lives. Why can’t people see that saying “entitlements” really means welfare and food stamps to 90% odf Americans? Why can’t we start calling entitlements what they are- “Congressional and Military Welfare”?

Andrew, it’s not just Americans who burden the entitlement system, it’s illegal aliens who come to the United States to have children, and thus get into “the system” here! I’m a retired nurse and personally witnessed the problem. Illegals would circle our hospital parking lot. in labor, until they were ready to deliver. Then the would enter the ER, knowing we HAD to deliver them! A fellow nurse actually had to deliver one woman on our steps…..

Do you think Warren Buffets money is stuffed in his mattress? NO! It is invested in stocks, bonds, businesses! That money benefits us all because it gets invested into companies who then hire employees who then spend money. On top of that the companies produce products that we all use. The companies create technologies that make us more efficient in what we produce which drives down the costs of those products. The technology in the ridiculously expensive Ferrari eventually makes it into the inexpensive Focus thereby improving the lives of the regular folks.

The rich DRIVE the economy. These people are rich (for the most part) because they know where to best put that money to work to CREATE wealth. The government never CREATES wealth, only moves it from one place to another and it is generally into their own pockets or the pockets of their friends.

Amen! This is the heart of it all…if you want to help the poor, you should advocate a policy of reducing taxes across the board. If you want to hurt the poort, support ‘soak the rich’ policies. Consumption doesn’t grow the economy, investment does. The less investment, the poorer society will be. Civilization advances when it’s capital is productively applied, and it shrinks when it’s captial is consumed. Government can’t create capital, or productively apply it…it can only consume it.

Everybody is entitled to their opinions, but it is hard to take definitive black and white statements like “Consumption doesn’t grow the economy, investment does” or “cutting capital gains tax” has a direct causal relationship with increase in tax revenues or creation of jobs. Any serious non-partisan economist will say that its slightly more complex than that. This whole “soak the rich” is a strawman that folks have created to attack easily. There are 3 different issues that people have been conflating in these threads: Entitlements (they are unsustainable at the current rate), Tax policy (as it relates to growth & jobs, and creating a society that doesnt contain as much un-equality that exists today), and deficits. They are all serious issues and all different root causes, and different short term and long term solutions and considerations. “Taxing the rich” is as silly of a solution to the entitlements issue as “across the board” tax cuts or eliminating tax capital gains or carried interest.

That’s the whole supply side argument which I thought everyone knew was a fraud by now but I guess not. Without middle class consumption, the wealthy would not sell anything.

To call supply side economics a fraud is fairly absurd…it’s a widely accepted economic principle, and has the weight of a tremendous body of evidence to support the theory. And production enables consumption, not the other way around. Some people might be inclined to call it a ‘chicken & egg problem’, as in which comes first, but that is a mistake. Man’s desire to consume is limitless…it is an acxiom of economic theory. If comsumption created production, every nation on earth would be the repository of endless wealth. So since the desire to consume is limitless, consumption must be limited to by the ability to produce. And in order to produce, an entreprenuer must deploy invested capital. Without capital investment, there can be no production, and thus no consumption. Therefore, the more invested capital, the more production, the more available to consume. Ergo lower taxes on the wealthy is a win for everyone.

Wow! Nice.

Military spending much? We have a military budget larger than the 17 next nations combined including arch enemies such as China. Think that could be reduced a little bit?

I will be honest Mike – I am a tech guy, a Sr. Mobile Software engineer making 120,000 / year with a benefits package that rivals that of Google. At this level I am paying close to the top level of income taxes. You will never hear me complain. I have been to Mexico, South America, Greece and seen what countries with no safety net are like. I have seen families living in squalor in highway medians. I have seen people lining up to get their money at failing banks in South America, only to find that their life savings are not available. To hear you talk about the issue makes me feel like you have no context about the degree to which you are really privileged.

So what do people like you and I (to a lesser degree) do in the world? Send emails? Ride airplanes. Drive our cars. Facebook and twitter at people. Maybe do a spreadsheet now and then and show up to work and sit in a cushy chair and type on a computer? We don’t deserve this position to nearly the degree you think we do – it is a function of having an unbelievably powerful middle class and global resource dominance and the ability to force OPEC to heavily discount our oil prices and gain tremendous economic advantages as a result due to our military might. I hate to say it – but you don’t work as hard as you think you do. You don’t mop toilets 12 hours a day or wake up at 6am to stand in front of a Home Depot hoping someone with a pickup truck will come by and let you mow their lawn for $30.

Two years ago, the company I was working at went under. I was unemployed for 7 months with no health insurance. I worked in a coffee shop 13 hours a day collecting unemployment trying to find a job. I taught myself to program and got to where I am today by working harder than anyone else. Do I deserve this? Sure. Now that I am here, do I take the attitude of “I am being persecuted by the government for having a heathly income? No. I will never whine about what I have and think anything other than ‘holy fuck, I am glad I am not an illegal immigrant or living in China where there is nothing to protect me.”

My advice to you is to travel the world and realize that you aren’t as great as you think you are. You are lucky. 95% of what you are is being in the right time and right place. Most rich people in America seem to think that they ARE that smart and that they are ENTITLED to the amazing gifts they have. The Republicans represent that mind set in a way that is inextricably linked to their internal culture. It’s ugly – the only possible way for anyone to think they deserve this is if they have never seen the world.

I have traveled the world, and I spent three years of my childhood in England. I saw the soviet union in 1980.

“Two years ago, the company I was working at went under. I was unemployed for 7 months with no health insurance. I worked in a coffee shop 13 hours a day collecting unemployment trying to find a job. I taught myself to program and got to where I am today by working harder than anyone else. Do I deserve this? Sure. Now that I am here, do I take the attitude of “I am being persecuted by the government for having a heathly income? No.”

…which is great but we still have to deal with tens of trillions of dollars in unfunded entitlement obligations. On your defense spending comment, see my comments above. It’s a drop in the bucket, and our defense spending even with the wars is much lower than historical averages. If you take away defense the first thing you have to deal with is a breakdown in world trade when the seas are no longer safe. Our navy allows the world to prosper.

http://mibi.deviantart.com/art/Death-and-Taxes-9410862

Please get informed properly.

“… but we still have to deal with tens of trillions of dollars in unfunded entitlement obligations.”

And how would cutting tax for the rich helps with this? I agree that we have to fix the unfunded entitlement obligation, but cutting tax for the rich would help how? Unless these tax cut is required to put back into the society somehow, we have no way of ensuring this tax cut has any benefits to the 99%.

arggg.

When the rich have more money, they invest it…it isn’t sitting in their mattress or buried in their back yards. When they invest that money, it is productively applied to create wealth…for example, by building a company or helping an existing company grow. The company that has access to investment capital creates products and/or services that 1) drive down prices, thereby making things like smart phones and computers cheaper, thus more available to the poorer in our society, and 2) are profitable enough to support a growing number of workers. So cutting taxes on the rich helps the poor 1) have access to increasingly higher paying jobs (as productively increases, so does wages), and 2) have access to increasingly more affordable products & services. And THAT is how cutting taxes on the rich benefits the 99%. If you take the opposite approach, you get the oppostive effect…things get more expensive and there are less jobs.

I should also point out that cutting taxes on the rich has in the past always generated more revenue for government. 100% of the time the capital gains tax has been cut, captail gains revenues for the government have increased. 100% of the time the capita gains tax has been increased, captail gains revenue for the government has decreased. So if you want to slash the deficit, cut taxes.

Roger, do you have any evidence to support that assertion? I’ll agree that there can be increased revenues from gains tax decreases but it is usually short term and related to rate changes. Then the obvious results are quickly attained: higher revenues with higher rates.

Absolutely. First, Ireland in 1997 halved their rate from 40% to 20%. Captail gains revenues rose more than 50% that year and had nearly tripled by the end of 1999. Next Sweden…captail gains rates varied considerably in the early 90’s, providing a really useful data set. After careful study, it was determined that a 10% increase in their capital gains tax resulted in a revenue reduction of 8.7%.

As for the U.S., after careful study a 1988 paper by a professor Lindsey concluded that you get an increase in revenue of 5.4% for every 1% decrease in the capital gains tax. In 2009 Dr. Paul Evans concluded that a 1% decrease in the capital gains tax would produce a persistent 10.3% increase in revenues. But let’s forget theory…how about actual experience: between ’68 and ’72 rates increased by 10% and revenues fell by 21%; in 1978 the rate fell by 15% and revenues increased by 46%; between ’86 and ’91 the rate was raised by 8% and revenue fell by 15%; between ’96 and 2000 the rate fell 8% and revenues grew by 50%. In 2003 the rate was cut by 5% and revenues grew by 45% over the next three years.

I could go on…there are about two dozen other international examples for which data is easy to find, and no counterfactuals, but you get the picture. I’d also refer you to the work of Nobel Laureate Robert Lucas who said that eliminating the tax on capital gains is the closest thing in the world to a free lunch.

woohoo!

This is a CBO chart for Income tax(individual) revenues from 2000-2009. Can someone explain to me how revenues increased by 45% after 2003. And look at tax revenues as percentage of GDP. Also please explain how tax revenues are directly and only dependent on Cap gains rate? What are ‘right’ metrics to measure government effectiveness – revenues? jobs? deficits? Trying understand the points made in this post.

Sorry here’s the CBO chart: http://upload.wikimedia.org/wikipedia/commons/c/ce/Federal_individual_income_tax_receipts_2000-2009.png

Hear hear!

Well said, Rob.

Well stated… Although between my wife and I we are close to the “1%” – I’ve always believed that where we live and how we live is a more a product of luck (and a ton of hard work, but not even close to those living day to day existences in 3rd world countries). The income gap in this country has grown out of control – the 1% do need to pay more, if for no other reason to close the gap, provide a better safety net, so the whole country can prosper… It’s an easy measure – the US middle class needs to hold 90% of the wealth of the country, when it does (or gets close to that threshold) the country has been healthy – when the gap gets too big (like now), the economy falters…

The US is living above its means… the answer is in the middle class, not the 1%

Your right, a rich man doesn’t spend all of his money on consumables like a poor man does, but that’s a good thing. Because what does a rich man do with what’s left over? He invests it. Without investment, there is no productivity growth, and no jobs. So take all you want from the rich, but you guess who you hurt…the poor. In addition to making products and consumables more expensive for them (by removing investment in processes and competition that increases efficiency and reduces prices), but you also reduce their employment opportunities. When productivity grows, not only does the pie grow, but the amount of the pie that can be shared grows, so everyone wins. You can’t give the poor more by reducing investment…and that’s the fallacy of the ‘soak the rich’ policies…they will always have the opposite effect of their intentions.

…I don’t see a “big” problem here. I will explain… started woeking about 12 hours a day at a gas station in Maryland when I was 15 yeas old. Managed to stay in school, went to college and grad shool [was the only one there driving a very valuable antique Porsche] had plenty of money. Kept working “smart,” saving, and fast forward to today: I own 14 [fourteen] diverse, profitable businesses, employing 126 people. I am a millionaire many times over, own multiple homes and… have two new Ferraris. I just turned 37 and, truly, never asked anybody for money and, above all, never been a member of the incredibly stupid “occupy” whiny gang…

What is my point? here in the US, anybody can make it big, no matter who is in the White House — It is, in essence, to look for opportunities and work hard. There are no secrets…

Correction: “Charles O’Malley”

Where does one even start with your comment , pwb. *sigh* Let’s start at the bottom. Jobs and investments—are they generally good and beneficial things, or bad and nefarious? Assuming you said “good” and that you’ve had a job…have you ever been hired by a poor person? Would it affect the economy in a good way or bad if many on the Left get their way with the punitive punishment and taxation on the rich and millions upon millions lose their jobs as a result?

Gov should allow people a one-time buyout option for SS. I would gladly pay a lump sum now, and help shore up the program for those going to use it, for the right to not pay social security tax for the rest of my life and also not receive SS when I turn 65. This also reduces their future liabilities.

They can determine the cost of the lump sum based on my age and do a net present value calculation. I’m sure I can earn a higher rate of return than they can.

The kicker here is they can just pass new taxes later to make up for my missed SS payments. Not sure how to fix that problem. 🙂

That only works if you agree to leave this country and not come back. Otherwise, you’re suggesting that you want to continue to enjoy the lifestyle we’re used to in America, fueled by a strong *and critical* middle class which depends on SS, but you don’t want to contribute. That makes you a tourist. You can achieve what you want by giving up your citizenship and leaving.

indeed. And you can theoretically still come and visit on a tourist Visa and live here tax free. Until you have to get out in 3 months.

Still, there are countries being designed to suck in wealthy creator types with very high standards of living and very low tax rates. Singapore is a prime example, although living in that fascist-fueled place is too much for me. I tend to exercise speech regularly and I suspect their government wouldn’t be to jazzed about that.

But other countries may emerge that deeply respect property rights and the right to self determination. I would strongly consider moving there if two many more of the wrong things continue to happen.

Sorry, the 50,000 is high. Maybe 500 or 5,000.

Fascinating read, although it’s also a bit demoralizing. How can we fix things?

I don’t think we will fix things until everything really falls apart. I’m planning accordingly.

Care to share any insight into what kind of planning you’re doing? Any references you could share?

Unless Im way off base here I would assume he referring to a societal and economic collapse. But maybe Im a prepper and dont know it!

How do you plan to mitigate? Curious to know.

Anyone who has an IQ above room temperature is already thinking about this and planning for it. The rest of us have already started planning.

DHS has purchased nearly 1.5 BILLION bullets. Its not for target practice.

the bullets thing is interesting. A neighbor of mine is buying tens of thousands of rounds. His argument is they last forever (even freeze dried food only lasts 25 years or so) and they’ll be currency if things really go to hell.

I’m buying tulip bulbs. 😛

Or your neighbor will experience the downside of a disrupting market if we ever get any sane gun control policies in this country.

Two issues: First, people making millions a year should probably be paying upwards of 70% tax after the first few hundred thousands or million, as they did from the ’30s to the ’80s. This would start the country on a path back towards economic equality. And there’s plenty of data to show that economic inequality is closely associated to societal harm (http://www.youtube.com/watch?v=cZ7LzE3u7Bw).

Second, there’s a shit storm of epic proportions coming towards the US, related to social security and health, and how that’s handled will probably define the direction and potential for growth of the country for at least one generation after it hits the fan.

People who argue that raising taxes for the rich will somehow shield the country from that shit storm are, as you say, misinformed or malicious. But people who deny the first issue by referencing the second are just as bad.

http://www.paoracle.com/SocialismWORKS!/index.php?sw=Sweden

You should not put any value into the work of someone who put dictature of the right ( one individual dictating ) in the same column as socialism.

http://www.paoracle.com/SocialismWORKS!/

and if you actually attempted at least to do your own part of the research, you’d know, that no one, in the US that is, ever paid 80% of their income in taxes. Effective tax rates were always way under 60%.

this is how I imagine you:

“I don’t think we will fix things until everything really falls apart. I’m planning accordingly.”

Same here. I don’t plan to be here for the fun. I have zero confidence in either party to head off America becoming the new Brazil. Both are incompetent and selfish in their own ways, but the end result will be the same disaster. Once our middle class is gone, it will take decades (at least) to recover because our national assets (spending power, global influence, innovation, etc.) will have moved elsewhere. It won’t just be a matter of correcting our course when we wake up, we will have to compete our way back into the role we enjoy today. Others will suffer too as our consumer market crumbles, but not as badly as we might arrogantly believe. Between India, China, and Brazil, a new middle-class consumer market is emerging that will dwarf our current spending power. We won’t be missed as much as we think.

Our middle class is like our ozone layer, and once it’s gone, we’re screwed. The middle class is the foundation of our prosperity. It provides the educated workforce and consumer market that support our businesses. The Democrats will bankrupt the middle class engine by over-spending on obsolete social programs that we can’t afford, and the Republicans will kill the middle class because they view it as cost, not value.

It isn’t untruthful that Romney/Ryan wants to cut taxes for the rich while simultaneously altering Social Security / Medicare / Medicaid. That is exactly what they want to do. The fact that our entitlement structure absolutely needs to be changed doesn’t mean the meme you’re talking about is untruthful.

Would it be preferable for Americans to think seriously about how these programs need to be changed and shored up? Yep. That would include things like means testing, raising the age for eligibility, reducing the disability rolls, and higher taxes (for everyone, not just the rich).

But the reason the HUGE TAX CUTS meme has so much staying power is because nearly everyone understands you can’t be serious about protecting these programs or reducing the deficit if you’re lowering taxes.

And it doesn’t have anything to do with “destroying” the rich. Allowing the Bush tax cuts to expire and returning to the tax policy and rate targets we had in the Clinton era would be super helpful. And not at ally tyrannical or destructive.

please read my article from yesterday about the rich (linked in this article at top). What you’re talking about is taxing the income rich, not the stored wealth rich. The income rich are already taxed to death. The stored wealth rich aren’t taxed properly. There’s a big difference. And, by the way, I’m promoting tax policies there which directly hurt me.

Ryan in particular has an abysmal record in actually dealing with issues such as unfunded entitlements, and his talk of being a fiscal conservative is at best wishful thinking and at worst an outright lie. Electing Romney and Ryan won’t do anything at all to solve the issues you’re referring to because they will cave on every tough decision when they need to buy favors from their base.

Democrats don’t have a solution to the unfunded entitlements issue, but to say that Republicans do is also untrue. Most of the time they are simply too busy whipping ignorance and bigotry up into a frenzy to spend even a minute thinking about how they would actually implement policies that make long-term fiscal sense.

Similarly, the way government works in the US means that one must either compromise and implement policy that causes both sides to hold their noses (probably a good thing) or stonewall and prevent anything geting done (definitely a bad thing). The GOP have shown themselves much more inclined to the latter in recent years.

Generally speaking I think your instincts about rejecting the GOP because of its obsession with issues like gay marriage are right, but the GOP also deserve to be rejected because they have demonstrated they don’t have any real will to address the big picture issues that concern you. My view is that you pick the Democrats and get the fiscal status quo or you pick the GOP and you get the fiscal status quo with a side order of vicious discriminatory policies. Pretty depressing.

LMAO. You’re right.

I believe the “Fair Tax” which taxes consumption would fix that discrepancy between taxing income and taxing stored wealth.

Yesterday’s piece is fine, as far as it goes. I agreed with most of it. I disagree that 35% or 39% is a big killer. Especially when you realize the effective tax rate (even for people earning $1 million plus in income rather than carried interest) isn’t quite so high.

That’s because the deductions available even to these folks are still quite generous (e.g., home mortgage interest, charitable deductions). I actually support getting rid of those deductions (all deductions should be eliminated). Then you can lower the rates. Also, eliminate the corporate income tax, which is distortive and unfair (taxes companies based on their models, rewards offshoring, double taxation).

But even if you can’t do any of that, no one’s getting destroyed at 39%. Is it optimal? No, for reasons you state and that I mention, but it’s not a catastrophe.

When I was a kid, my father paid a 90% tax rate, and he was proud to pay it. He pointed to it as a sign of his success. And he taught he just to make money, and not to focus on tax avoidance strategies.

my understanding is that no one ever actually paid those tax rates. If the government tried to tax me at 90% I’d be leaving the country.

your father paid income tax, that had nominal rate of 90%. I would eat your shoes if you prove to me that he paid a rate close to 60%, even. I doubt very much that he did.

The stored wealth versus income rich comment is a great dimension to think about this problem. That is why Bernanke is keeping rates low right now: low rates is an inverse tax on stored wealth. If someone holding cash, treasuries can’t get good returns, then they are forced into riskier strategies which actually benefit society – investment into equities and VC drive future economic growth due to firm and job creation. Part of your problem Michael is that you’re now part of the semi-retired and you’re trying to figure out how to protect your pile. And it has to be pretty scary to think about the fact that you should actually be invested on a levered basis into risky strategies. But that may be the best route in a dollar-deflationary environment.

“The income rich are already taxed to death.”

90% tax bracket in the past and the super-rich were still wonderfully comfortable, wealthy, powerful, etc.

Are you saying a 90% tax rate is a-OK? how profoundly shallow minded can you be? Had those 90% rates held, it is quite likely that many things we take for granted today (and that even the poor have today) (mobile phone) would not even exist. Think about it.

what many of you dunderheads fail to comprehend is that capital not seized (taxed) by the Government is capital that stays in the economy. So many idiocies on so many levels here…but I can see that most of you lack even the most basic fundamentals of economics it is not worth my time to school you.

90% tax rates are not ok. Anyone who argues that is an idiot, in my opinion.

Our military spending is twice what it should be. If it were half what it is today, America would still dominate with a force several times larger than any other nation. The military industrial complex is corrupt and those who benefit from it prey on the gullible who are easily convinced that China and Russia are still threats in a conventional sense. They don’t understand, for example, that China is our largest shareholder and and has nothing to gain from a traditional conflict.

I think we spend more than enough on health care and education, but we don’t get nearly enough value for what we spend. America is becoming globally uncompetitive in the delivery of affordable high-quality health care and education to the middle class, and that is a huge threat to our economy and standard of living.

The health insurance companies have failed us. Free enterprise has not worked with health care. America leads the world in health care science and technology, yet we are woefully behind in our ability to *deliver* basic health care services to mainstream America for a reasonable cost. We don’t need more money for health care, we need dramatic reform and yes, maybe more regulation until costs are brought under control. We need some out of the box thinking, not ‘stay the course’ thinking.

We’re also failing at education, but I don’t think it’s about money. I think our state and local school boards, and the teachers unions, have failed us. We pass students with a sub-standard education and push them out into the world. Instead of holding them back and flagging a problem, the schools graduate functionally illiterate students because doing otherwise would make the schools look bad. We lay off young and enthusiastic teachers at schools that have indoor air-conditioned practice facilities for the football team. Could there be a more broken set of priorities? How does that strengthen the middle class and America’s competitiveness?

No Kyle, 90% tax rates are not ok. But neither is the Republican attack on the engine of America – the middle class. It’s not just about money, it’s about attitude and priorities.

I agree with you here. But even doing the correct taxing of the correct rich won’t correct the underlying problem of the debt, which comes from health care costs and elevated defense spending.

Taxed to death? Really? http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=213

But that’s a super important point. We need to reform THE WHOLE TAX CODE in order to get at the non-income super rich. I am a HENRY high taxed earning person, and really, I deserve it, because I’m too stupid to have moved a lot of my income to investments yet. Romney (or Rmoney as I prefer to call him) has just exploited the existing tax code.

While all those numbers are scary and over simplifying either side of the debate is dangerous, the real takeaway is that healthcare costs are currently at completely unsustainable levels. Privatization does nothing to control these costs and a single-payer system does nothing immediately to address them (and, in the short term, possibly makes them worse). Since we don’t live in a country where we let people die on the front stoop at hospitals, the government/taxpayers will always be paying for healthcare regardless of how fiscally conservative we are. So, how do you control healthcare costs? Neither side in this election really has a strong point of view on this because the reality is so politically damaging. The solution involves taking the profit out of healthcare and making it the most highly regulated industry in our country. This also means coming to grips with a much more scaled back approach to what we consider necessary medical care and some aggressive approaches to wellness that many will think infringe on personal liberties (the Bloomberg giant soda ban is a very early stage of this). It is truly a no-win situation for citizens of this country but the sooner it begins the less damaging it will be for future generations. The word “entitlement” tends to flare up this debate instead of just focusing on the word that matters: reality.

Excellent Peter!

Peter, your argument sounds good but I think a little misinformed in just a couple areas. Before Medicare/Medicaid acts were passed, hospitals weren’t “required” to take on dying patients. Despite this, if you go and look at the data, people weren’t being left on door steps dying before the Medicare act. Hospitals chose take in these patients (at a known loss) because it’s the right thing to do. if they ignored the sick and uninsured, it would be bad business (would you go to a hospital for service that let people die?). They were able to do this because they were actually profitable enough to take on the losses. They were profitable because the government didn’t undercut and peg what rates to charge for services (i.e. Medicare). When govt started interfering with an otherwise free market, it got all out of whack. Lo and behold, insurance companies started requesting the same rates and now people wonder why services cost so much… Now that is a very simplified version of events and there are many other issues driving up the costs of healthcare as well. But blanket statements of “we don’t live in a country where we let people die on the front stoop of hospitals, the government/taxpayers will always be paying for healthcare…” You’re right, we don’t live in a country like that, but we also don’t live in a country where the responsibility is 100% on the government to solve for us.

There must be a balance of all moving pieces for us to get out of the mess. The point of this post is that there isn’t a “one-cure all” solution (which you eventually stated towards the end of your post).

I think we’re in agreement. Hospitals will always have to be profitable enough to take on losses or else they’ll cease to exist. However, as the numbers of uninsured increase, so does the burden on the hospital to make up those losses, which is at least partially to blame for the escalating costs of overall healthcare. Unnecessary procedures that have very little to do with extending a meaningful quality of life is another big part of those escalating costs. If you could eliminate those costs, you’d be closer to the solution than anything we’re talking about here.

The era you’re referring to in which hospitals treated patients on the basis of goodwill is the same era that Ron Paul is from and why he believes that we should all be left to fend for ourselves.

The reality is that most hospitals are now run by their equivalents of ‘Bain Capital’ and are run first as profit centers and second as care-giving facilities. You better believe that there will be people shut out if admittance decisions are left up to the accountants.

The notion that anyone is out to destroy the rich is ridiculous. Everyone wants prosperity. Aggressive tax evasion is irresponsible and does nothing to improve the situation you have described above. In fact, it only worsens it, to a similar degree that a lack of jobs worsens it by taking away the taxes that the middle class would gladly pay just for the chance at a good job. As for your numbers, my impression is they are based on assumptions that our current cost of care will be outpaced by the same lack of funding that we see today. Keep in mind that we are seeing historic low revenues to the federal government from taxes because of the triple whammy of a wrecked economy (thanks Bush), tax evasion by the rich and a lack of jobs for the middle class. Many Americans are still trying to work their way out of debt and mortgage obligations from long periods of unemployment and still can’t really afford health insurance. Can we solve this problem? I think so, but it’s going to take a much more radical approach than anyone is advocating today. The primary problem as I see it is the medical industry is the 6th largest industry in the US and it makes a hell of a lot of money off Americans in particular. Equivalent health care anywhere else in the world costs far less than it does here, with no real reason other than aggressive market pricing and I would add, a pervasive, longstanding machinery in which insurance companies, hospitals, pharmaceutical companies, government funding sources and providers have spun up costs by overcharging, profiteering, and patting each other on the back for it. This combined with the high cost of medical schooling is wrecking American families. The narrative that allows this to continue is that all this profiteering pays for medical research. It does not. That is a lie. The other great myth is that long term care for the elderly and the chronically ill is extremely expensive and increasing as more boomers age. That too is a lie. It doesn’t have to be. We have got to hack away at the bullshit these industries have been selling us and eliminate the waste, profiteering and fraud. This will require massive initiatives, strong public backing, and the will to prosecute. There’s just no excuse for $200 bottles of pills, $3000 x-rays, $10,000 room nights and $300,000 surgeries. You’re not seeing that anywhere else in the world and we rank far down the list in quality of health care. It’s baseless, it’s criminal, it has to stop.

interesting point, the Meeker report has a slide somewhere showing that even though we spend way more per capita on health care than anyone else our lifespans aren’t increased.

And then if you add in the cost of medical error in overtreating people, health care is a crooked business playing with our lives.

Exactly. We have pharmaceutical companies selling doctors on the need for 5-6 generations of new pills for the same ills and they aren’t producing noticeable differences in outcomes. But they do cost a lot more. Also there’s no relation between the cost of surgery and the depreciation of equipment in the room. Classic profiteering. In fact, most surgeries are done outpatient in clinics, not hospitals, so we should be seeing a drop in costs for a wide number of procedures. But the biggest area for improvement is in preventive health care, and this means getting health care to people before their illnesses become more expensive. We’re just not doing it.

I am not advocating socialized medicine, but the country that spends the least per capita on healthcare, and has some of the best health outcomes is France.

The health industry has done a bang-up job of convincing people that proponents of the healthcare system used by virtually all other first world countries (i.e. universal care, government directly picks up 90%-100% of the bill and sets/negotiates prices with providers or owns and operates the infrastructure directly) are literally the devil. So, good luck clawing your way out of that hole.

But ultimately they’re two separate problems – Regardless of these unfunded costs, there is growing economic inequality today that, combined with tough economic times, can only lead to social anxiety and ultimately some kind of revolt or lash-out (consumerism only serves to calm the masses when we all have money to go shopping). And there’s data to show that this kind of economic inequality is closely linked to social harm by almost any parameter of your choice – http://www.youtube.com/watch?v=cZ7LzE3u7Bw

Mike, restoring taxes to Clinton era levels would solve a lot of these problems.

You are right that there is a deficit problem. However, the Romney/Ryan budgets only increase the deficits more than Obama’s proposal (per independent Congress Budget Office analysis). It’s unfortunate, but on economic issues, the Democrats have the less-evil proposal right now. It’s Bush that gutted the budget surplus of Clinton, and Romney/Ryan basically follow the same playbook.

The graphs you show are scary, but they are dishonest. Is it cumulative liability of medicare up to 2085? Or until 2065. I can’t read the fine prints at the bottom. The honest version of this usually plots the cost of these entitlements as fractions of GDP.

As a fraction of GDP, Social Security stabilizes after the retirement of baby boomers (it increases a bit then goes flat). It’s funded till 2033. So it’s easy to handle, but does require a bit more revenue. If you do nothing, you can still pay 75% of current levels after 2033.

The issue is Medicare/Medicaid, which grows faster. Because of aging population. It grows in an unsustainable manner, which means: it won’t be sustained. If you are serious about this problem, I would suggest you invest in technology solutions to reduce cost of healthcare. After all, you have an investment fund.

Like

Great to hear this clear headed approach! Now the question is: “what are YOU going to do about it?”

“What are the investments YOU need to make to help fix this problem, while at the same time build a billion dollar company?”

How can we create on-line jobs for ‘normal’ people – and make that a business at the same time?”

I think it’s odd that you find yourself so superior to “normal” people that you have to figure out a way to build a job for them. Capitalism is a fantastic mechanism for turning greed into jobs, and lots of them.

Capitalism would eliminate every job (outsource or automation) if it could, with a focus on building “stored wealth”. We have to adjust the economic “environment” in response to issues that arise in the economy. Changes in taxation rates and rules are among the levers we have. Right now, we need to strengthen the middle class, increase taxation on the rich (particularly on capital gains, or non-productive income), and ALSO innovate in areas where costs are accelerating, i.e. healthcare. Welfare reform definitely needed. Education reform will be a part of that solution.

When it comes to government spending, what we don’t pay for with taxes, we will pay for with inflation. But not as long as someone else is willing to finance our deficits, when they stop financing us, inflation really begins. By buying gov’t bonds to keep rates artificially low, the fed is accelerating that process.

“Either way everyone is going to get crushed.”

Actually, not everyone. Those who see it coming (especially the rich ones) are able to speculate and profit from inflation while everyone else gets crushed. Of course, that’s still short-sighted, unless, they escape before the system collapses.

They say death & taxes are inevitable. Well, I would say death, taxes, and inflation. All currencies eventually return to their intrinsic value.

Social Security and Health Care are two different issues. You can’t lump entitlements into one bucket. As for Social Security, I think the public bears some responsibility for this, and a few financial titans the rest. The Boomers will need Social Security because the value of their homes, which they were going to use as retirement, faded in the housing bubble. They have paid into Social Security, and they will get it. In the future, a way to fix it is to raise the eligibility age in accordance with statistical longevity tables.

As far as the health care situation is concerned, entire US (practically) is obese, and thinks it can eat and behave any way it wants, and the health care system will fix it. I have been working on trying to disrupt health care with an emphasis on prevention for 25 years, and the only one I have fixed is myself, Chronic diseases like diabetes and heart disease are almost entirely preventable, but people don’t care enough. If we do start rationing care (which means raising the Medicare eligibility age and refusing to give liver transplants to alcoholics, etc) we could fix health care costs right away. Also don’t overtreat the elderly who are in the last six months of life with incurable diseases

I agree with Peter. Privatizing it won’t fix it, and neither will universal health care without rationing.

I found a blog entry where Dr. Schwartz proposes an interesting solution: Preventive only healthcare.

http://charleshughsmith.blogspot.com/2012/08/a-sustainable-national-healthcare.html

Most chronic conditions are preventable, and that’s where the focus needs to be. If you are already sick and can afford to spend infinite amounts of money staying alive, by all means. I’m sure charities would also continue to help in this respect (and more than they do now), particularly for diseases like cancer which are less preventable. Otherwise, we simply can’t afford to spend infinite amounts of money keeping everyone alive, and fighting the natural order of things. With less demand, the overall cost of healthcare would go down too.

Everything the government throws money at becomes more expensive. You have more dollars chasing the same goods. Look at the examples: healthcare, education, housing.

As for Social Security, I think everyone should be able to opt-out (and forfeit what they’ve already put into it). After 10 years paying into it, I would opt-out in a heart beat. For those remaining, the overall output should match the overall input. Social Security is the world’s biggest Ponzi scheme.

If your three year old gets cancer, then let’s discuss how comfortable you would be to sit back and let the natural order of things happen. We can also discuss how you would spend your time fund raising from charities to cover your child’s treatments rather than spend time with him/her or educating yourself on the treatment options and what happens if you’re not successful in raising the required amount on time (sometimes within a couple of days of the diagnosis).

Since healthcare and market forces have been brough up in comments, I’d like to point out that the combination doesn’t always produce the desired results. There have been literally two (2) drugs approved for treatment of childhood cancers in the last 20 years.

Even though _every day_ about 40 children are diagnosed and 7 kids die (usually after enduring painful and debilitating treatments) the market is not profitable enough for the pharma companies to invest. Partially because pediatric cancer isn’t a single desease, but there’re 12 major types.

There’re pediactric cancers that have 0% survival rate. The 80% rate overall that’s often mentioned is only for 5 year survival. Most pediatric cancers don’t have a known cause and therefore, unlike adult cancers, cannot be prevented.

Michael, look at your graph from 2000-2008, guess who had the presidency, congress and the senate? Republicans. Did they do anything about any of this? No. Why because a large portion of their voters are old people.

Voting Republican will not help any of these big problems. Neither will voting for the Democrats.

So the lesser of two evils are Democrats because at least they are sane and believe in Science and Equality.

read http://www.forbes.com/sites/peterferrara/2012/06/14/president-obama-the-biggest-government-spender-in-world-history/, all of it. I don’t like the way the republicans spent in the last decade, but we’re in a whole new game now.

And the lesser of two evils are the independents. Both big parties are absolutely willing to kill this country, as long as they get elected first and have a couple of good years.

Agreed. Both are not great and Independents would hopefully be the answer, but no one is close to filling that role.

Are you telling us to read this Peter Ferrara http://en.wikipedia.org/wiki/Peter_Ferrara? I wouldn’t take this as serious analysis. The Obama biggest government spender trope has been debunked already by independent unbiased analysts.

IUAs? Frankly, I don’t believe they exist.

How are you planning accordingly? That leaves us in such suspense, arrington. GOLD? Silver? Investing in China?

Mike, while I applaud your stance from afar (UK) as it sits in contrast with the assumption that many in the entrepreneurial sphere in the States seem permanently wedded to the Democrats as they seem defined more by an ideological opposition to the Republicans, could I pose you the following question;

In your previous post you wrote, “I won’t vote for a Republican again unless the candidate explicitly approves of gay rights and is pro choice.”. While I agree with you without reservation on both matters, given the scale of the impending problem can you say that the short-term politics of gay-rights (i.e. getting final, equality for everyone) and pro-choice (i.e. not denying women access to modern f###ing medicine) are more important than trying to prevent/ameliorate the consequences of a $47T ‘problem’?

Gay rights, in a long enough time line will be rectified.

‘Pro Life’ is like Intelligent Design; an idiocy with inevitable expiry.

$47T however is something that could set back the States decades. Perhaps set it back irreparably.

Might it be better to bite your tongue on the first two for now?

The “tax the rich” soundbite is an easy strong man to knock down. There’s no question we have to address the entitlements issue. But the problem a lot of people have with Romney is that he’s very specific about what he wants to do with taxes (cut them, especially for the highest income earners), while being very non-specific about what he wants to do with entitlements. That leaves a lot of room for people to speculate and create the kind of sound bite you’re criticizing. But it’s a bit misleading to use a statement like “destroy the rich” when what is being proposed by Obama and others is simply a return to tax rates on the wealthy as they existed prior to 2000, which were historically low. Hyperbole cuts both ways and is equally unhelpful to both sides.

In 2011, the Federal Government took in about $2.1 Trillion in tax revenue.

In 2011, the Federal Government spent about $2.1 Trillion paying out entitlements (Social Security, Medicare + Medicaid, Unemployment Insurance, etc).

All the revenue was spent EVEN BEFORE spending a dime on defense, interest on the debt, or anything else.

And we all know interest on the debt is massively artificially low.

At present, the average cost of Treasury borrowing is 2.5%. The average over the last two decades was 5.7%. Should we ramp up to the higher number, annual interest expenses would be roughly $420 billion higher in 2014 and $700 billion higher in 2020.

I’m an optimist at heart, but this ain’t gonna end well…

Meeker’s report is problematic to the point of disingenuousness. Read the fine print. To get that absurdly shocking figure she projects through 2085. That reveals a stunnning ignorance, or perhaps deliberate distortion, of how medicare and social security budget management have historically worked.

Congress has tweaked the benefits over time to keep it afloat. She simply projects out 74 YEARS while assuming no tweaks. Ridiculous.

What’s even more absurd is using this as a basis to claim tax cuts on the rich wouldn’t matter anyway, because LOOK AT THE BIG RED CIRCLES. Of course they matter. Try projecting those out 74 years.

But no, government programs bad, tax cuts good. Except all those trillions of government spending that created silicon valley.. Oops, that’s not very Libertarian, we shouldn’t talk about that.

Politics is an industry” >> http://www.libertyff.com/-industry.php

“Per FEC Data, as of 4/19/2012, more than $1.2 trillion had been spent on this election cycle in political contributions. Let’s compare that to Industrial Gross Output, or Output by Industry, before taxes and such, and we find some interesting things. Very few industries generate more cash, prior to costs, than we see in contributions.

Source data >> http://www.bea.gov/iTable/iTable.cfm?ReqID=5&step=1

Politics is Three to Four times the Size of Mining, Oil & Gas, the Agriculture Industry or Utility Industry.

Politics, as an industrial sector, is larger than: Arts, Information, Transportation, and Wholesale Trade. These folks are larger players in the political game, but still don’t have adequate say.

Politics, just looking at contributions, is about the same size as: Education, Retail Trade, and Construction. Accordlingly, these industries have very large political funding machines.

Politics is an industry of similar size to: Business Services, Real Estate.

Politics is a small industry, roughly One Half the size of, ALL Fed, State, and Local Government expenditure.

Politics is One Fourth the size of the following industries: Finance / Insurance, and Manufacturing. Yes, the finance and insurance industries are as large as the manufacturing industry in the USA.”

Entitlements need reworking. But Romney-Ryan touting huge tax cuts for the 1pct is incompetent stewardship.

In old USSR my grandma told when you don’t have money you don’t build communism!!!!

This country doesn’t have money, doesn’t matter how large you tax “rich” ( I personally call them investors) it will not be enough.

It means we have 2 things we have to do:

1. Poor should also one way or another start deducting to the economy if they wish to receive something receive back from the economy

2. Government spending should be drastically cut both on Fed and State levels. No more pensions for gov workers from 50 years, start from 67 as private companies workers, no extra benefits, should be found the way to pay less for medical expenses, idea of GOP to use vouchers not so stupid ,for example something similar has Israel, gov pay for each insured head specific voucher to medical insurance company. If insurance company can not attract people, they just don’t have this voucher. Make insurance companies fight for clients

My dad did. He was a highly successful New York entertainment lawyer/personal manager and he was proud to do it. That generation remembered WWiI and the Holocaust and they took nothing in the US for granted. We feel differently about our country and our government now.

I’m a middle-age, white male and a fiscal conservative who made millions as an tech entrepreneur by age 24, and by income I’m easily a 1%’er — in other words, the archetype Republican. But after 22 years as a life-long Republican, I switched parties this year. Maybe it’s a mid-life crisis, or maybe it’s this: as I thought about Obama, Bush II, Clinton, Bush I… it dawned on me that the *Democrats* have a better track record of balancing spending and taxation than Republicans! Republicans are great for tax cuts, but certainly not spending cuts (see Reagan, Bush I, Bush II). It was *Cheney*, not some liberal, who said “deficits don’t matter.” A cursory search for deficit and debt trends since 1980 will make my point pretty clearly. And so sometimes, I find the political discourse ironic — Democrats are defensive on an issue where, IMO, their track record is superior. (And please don’t use TARP or something similar against Obama… this may not be a popular view but I happen to believe that Paulson and Bernanke, and Obama by continuation, saved our bacon from a crisis that took root long before Obama was in office.)

I love my country. I want my kids to grow up in an even better and stronger America. I haven’t changed. I just think the Republican party has lost its way as the party of fiscal prudence. And Mike, I agree with you, to be clear. I just reach a different conclusion about who actually has a better chance of leading us out of this hole.

Well said.

Well said. Democrats don’t have a great track record either; to be fair, it was the combination of Bill Clinton as President and a Republican-controlled legislature that was able to get things under control for a brief, shining moment in the 1990s. Nevertheless, I don’t think anyone in my lifetime has done as much fiscal damage to the federal government as Bush-Cheney.

2 issues.

1) Most people do not understand the basics of personal finance. Whereas English and geometry are part of the high school education… we currently don’t incorporate the basics of personal finance, including the time value of money, assets & liabilities, etc.

2) Time Perspective. The source of almost all arguments is that people place a different weight of importance around things that are happening now, vs 1 month from now, vs 1 year from now, vs a generation from now. Unfunded entitlement programs are an extreme example of this issue. Matters a lot to our kids… but not too much to my 91 year old friend.

Glad that we are having a civilized conversation about this stuff. And we should all respect our leaders… national, state and local. While we have the luxury of being in the peanut gallery, these individuals took a stand and fought for something. Maybe not too different than your gladiator analogy for entrepreneurs. Until we are willing to step in and start making the tough decisions ourselves, we should temper our rhetoric and give our leaders the benefit of the doubt.

People with money are bad, everyone knows that.

QE3. Doesn’t that solve all of this trouble! lol

perhaps it would be simpler to rename all the entitlement programs to simply “welfare”, and only provide it for those who will (with some proof) starve without.

So Mike, are you saying that because “taxing the uber rich won’t solve the ENTIRE problem” that we shouldn’t tax them at all? You and I agree on many things–holding our nose and voting democrat over the social issues (especially with me as a woman), and most relevantly, the belief that entitlements can break us. But we can’t let perfect be the enemy of good and refuse to raise taxes on the super rich or even the partly rich, or as you rightfully suggested close that damn carried interest loop hole. Neither party is doing what’s right and finding the compromise, middle of the road solution. But I will give Obama credit for this: at least he put forth a plan that cut entitlements AND raised Revenues. The republicans only want to cut entitlements. Both have to be done, or we are all going down the drain together.

I’m saying it won’t have any effect. But if you read my previous post I’m advocating taxing myself at a much higher rate than I am now. When you say “that we shouldn’t tax them at all?” though I understand where you’re coming from, and I think you’re just dead wrong. Anyone who thinks we don’t already tax the shit out of the rich is just deluded.

Hey mike, please unblock me on twitter. http://twitter.com/loyals sometimes I am just out of mind and saying sh*t 🙂

100% correct that it’s intellectually dishonest to continue ignoring the entitlements issue. But I think it’s wrong to argue that inflation or entitlement cuts are basically fungible. They’re not! The former will crush asset owners while low income folks will see their debts reduced in real dollars. The latter ensures that USD asset holders continue to prosper.

That’s basically a rich v poor scenario, but the default (what happens with no action) favors the poor. So the onus is on republicans to paint a compelling picture of a way out.

“Because destroying the rich will do absolutely nothing to fix this problem.”

This is bullshit. Every dollar of incremental tax revenue collected is a dollar less that has to be cut from expenditures, whether on entitlements or anything else. At the margin, it will make a difference. We can debate whether it’s a material difference, but it’s non-zero.

Don’t get me wrong, I’m a strong proponent of entitlement reform — in addition to a thoughtfully reworked tax code — but this kind of politically motivated statement is just as wrong as the left-wingers’ overblown rhetoric.

“Every dollar of incremental tax revenue collected is a dollar less that has to be cut from expenditures, whether on entitlements or anything else.” – Come on, you’re too smart for that. First, all the wealth of all the rich isn’t enough to fix the problem, or even close. And removing all that wealth from the private markets would lead to mass unemployment and economic destruction. Taxing the rich makes the problem worse. Do it to make the masses feel good, and then fix the problem by destroying entitlements.

People don’t understand that it won’t just be the fat that’s cut. It’ll really hurt the people who truly need help from the government. They’re the ones that will feel the most pain.

The reason that we have so much instability in the financial markets is that there’s an overabundance of capital. And yes, there is enough of it out there to solve the government’s fiscal problems.

It’s why everyone booed Ron Paul in the debates this year, when for the first time ever, a politician really talked about medicare/medicaid. He dropped the bombshell on everyone that it is insolvent, we have no way of making it solvent, and it will have to go away. They wanted to throw tomatoes at that “nut job” and “crazy loon”. Hilarious to see people on here arguing for inflation because it reduces debt in real dollars for the poor…UH, unless inflation increases more rapidly than wages, which it does and will do…then the only debtor it will help out is the federal government. Inflation wipes out the middle class.

So do I have this right: the whole Simpson-Bowles effort was coming up with ways to fund this unfunded $66 trillion? Is there anything in Simpson-Bowles about calling for changes to the whole entitlements approach itself?

well I more interest in your comments discussion rather than your post 😛 , still watching the next

The issue is that both political parties, paid by the healthcare industry lobby, do not want to look at the real issue which is Medicare and Medicaid costs because it is making the this industry extremely wealthy and by keeping people sick because they are more profitable. Fix the problem and you fix the Medicare and Medicaid entitlements. All other arguments are bullshit. Also look at the 2011 spending Discretionary ( Wars ) and Defense were just as much as entitlements. http://en.wikipedia.org/wiki/File:U.S._Federal_Spending_-_FY_2011.png

Each time I see, or hear, somebody create fictional economics I am reminded of this… http://www.kpcb.com/usainc !!! It’s sad that we need Mary Meeker to teach people simple math. Much agreed Mike, Democrats or Republicans is inconsequential, how about focusing on basic accounting…scary

thank you.

I’ve read Mike’s last few posts on this topic and also read through the comments. When I step back from the dialog, I find myself somewhat dumbfounded and I have to ask a fundamental question: are we Americans generally stupid or are we just hopelessly lost?

Here’s why I ask the question:

1. Our health care is broken yet we protect it. Any educated person who has reviewed what’s going on in the rest of the world knows that our national health care is sub-standard relative to just about every other first world country, yet we pay more than any other country and we resist change. Sure, as the health care lobbyists tell us, we have the world’s best doctors and medical centers, and when the richest people in the world need complex medical procedures, they come here. That takes care of the 10s or 100s of thousands (or even millions) of people who can afford it. What about the 10s and 100s of millions of people who can’t? Why do we pretend that our system is great and we’re well-covered for a reasonable cost? As a country, we aren’t well served and the data is available. We don’t need to cut services until after we’ve repaired them and see where that leaves us.

2. Our education system is becoming uncompetitive and we’re letting it happen. We fund it on the local level so we have lots of have and have-not schools. In too many cases, sports funding is ranked higher than teacher salaries. Anyone who participates in Internet commenting understands what I say when I assert that a huge portion of America is borderline illiterate. These adults wouldn’t have passed 3rd grade spelling or grammar when I was a kid. A solid education is at risk of becoming another casualty of a crumbling middle class.

3. Our military is out of control – we spend way more than we can afford or need. Yes, Mike, we need the seas to be safe and our business interests abroad to be protected. BUT, could we do it for half the current budget? Sure we could. We are not going to fight battles with China or Russia on the open seas or on the ground. Our battles with them are going to be economic. As a last resort, that’s what our nukes are for. Who does that leave? The Iranian navy? The Somalian pirates? We don’t need the current level of spending to manage the tier-2 and lesser threats. Imagine if we took half the defense budget, applied half of that to the deficit and invested the other half into employing people to upgrade our national infrastructure. You know, just like we did after WWII. That would have real impact. We can’t sustain our current level of military spending, and we don’t need to.

Bottom line: we need a solid middle class or America as we know it is going to die. We are going to become a second-world country of haves and (mostly) have-nots.

The pillars of a strong middle class are education, affordable health care, a strong national infrastructure, and high employment (spending power).

Why don’t we instead create things? Make the people who have less into those who have more. Redistribute through business practises instead of waiting for some politician that just talks and talks and talks. I am from Metro Detroit and my focus is creating the jobs and money for those willing to work HARD for it. It’s like the Internet, not the work of one person with big ideas but a combination of millions of ideas working all over the place. Just a thought.

What about military spending?

“One of the big talking points for people is the notion that the Republicans want to “sharply cut social services for the poor to pay for huge tax cuts for the rich.”” …. You make a valid argument against this talking point.

Let me change this a bit. Republicans want to “sharply cut social services for the poor AND GIVE huge tax cuts TO the rich.”

In fairness your argument for needing to reform entitlement services is still valid. However I would like to hear how you justify the tax cuts especially in the context of, as you have illustrated, our large and unfunded obligations.

There seems to be a bit of rhetoric that implies that “the rich don’t pay enough taxes” means that the rich should pay all the taxes. Its a way to avoid a reasonable discussion.

Rich people don’t invest all their money, many of them sit on it; when they do invest it, they sometimes (often?) invest in something where they pay people minimum wage with no health insurance and this makes them richer.

The primary issue here is that in countries with greater income equality, where the rich pay even more than the admittedly large proportion they pay today, economic growth and employment have both been much more robust. As it was here when our U.S. tax brackets were much greater: http://commons.wikimedia.org/wiki/File:Employment_growth_by_top_tax_rate.jpg

Similarly, single payer Canadian style health care would save 40% (that’s $1.4 trillion/year) because of preventative care and cutting insurance company overhead. We all pay for 5-10 years of usually terminal cancer treatment when poor patients are caught in the emergency room at stage three when preventative care could have achieved a complete cure in a couple outpatient visits. That’s most of the Medicaid costs right there. I don’t see any mainstream Democrats clamoring for single payer, but Obamacare just isn’t going to cut it.

But again, if we want the kind of growth and employment to really tackle these long term issues, we need greater income inequality, and the easiest way is to go German / Netherlands / Sweden-style with even greater taxes on the rich.

Am I the only one on this list that sees the medicare and medicaid liabilities not as financial problems but technologies problems? these are huge opportunities for development of biotech, new services, and info tech. talk about these problems reminds me of the population explosion and famine talk of the 70’s and early 80’s What happened? technology happened (e.g. Norman Borlaug et.al). certainly there must be structural reforms (inevitably we get to a single payer or something like it) but mixed in with that will be huge opportunities for technology.

This talk about the shift in taxation and income accumulation at the top seems overly localized. Most people on this list seem to ignore the underlying process of economics. When you play with a model, even a simple economic model, accumulation of income at one end leads to a reduction of middle incomes, a reduction in overall spending, and a general slowing of economic development. this is because money must flow through the whole economy to generate economic activity throughout the economy.

The wealthy have very few avenues to cause money to flow towards the bottom, the middle have many more(both up and down and sideways). What usually happens when money accumulates at the top is an increase in the size and frequency of investment bubbles. this happens because capital can only flow down a small distance into investments, and too much capital flowing down causes a localized inflation of value in some part of the economy (a bubble). For example in housing or tech stocks.

you can always tell what a bubble is because the people who push money into bubble do it not because of a rising gdp, but because their investment grows as demand for the asset rises. economic bubbles are asset bubbles, where the actual value of the asset to the whole economy does not change, only it’s price. When housing prices diverged from rent prices was the start of the bubble, because renters (the lower end in the economy) could not pay more in rent.

At the bottom, near zero assets, there are minimal prices for things. food, rent, that must correlate to labor prices. But these are not assets and hence do not grow the economy. it’s asset development that grows the economy. And that means more people creating more assets. ie, enlarging the middle class. Lasting economic growth is about asset creation, as income flows to the top it restrains the asset creation of lower classes.

The social safety net is about reducing the overall costs of care for the young, the old, the sick, and others so that the middle and lower income groups can engage in asset creation. A middle income person can start a startup, or care for their ill and aged parents, but not both.

Trickle down works, UP TO A CERTAIN POINT. after that point it is wasteful and produces bubbles and actually reduces gdp. why? because the few people of wealth cannot figure out what products are of real value to middle and lower income consumers. the knowledge to create those products is localized in those income strata. Look at the great achievers of our age (or any other). they come, in bulk, from the middle class.

The simple rule is this: the wealthy cannot CREATE assets (technologies and products of all kinds) that grow or advance an economy. They can INVEST in the creation of those things, but the actual creative act is done by people who are striving to become middle class or wealthy. this striving looks and feels like survival oriented behavior. And as wealth accumulates to a person, their behavior shifts away from striving and achievement oriented efforts towards status oriented activities.

Status plays a role at all levels of human society, but it has a dominating role among the highest incomes. This shift in focus away from survival and striving to enhance survival, chronically inhibits the wealthy from being progenitors of asset creation. creating assets requires a curious mix of capital, free time, education, expressive liberty, drive, and need. The economic system the best produces these conditions will out do all others.

the wealthy have little need to create assets; they already have them.

I would encourage the techies on the list to spend a weekend or two and code up their own little models of economics. supply, demand, production, consumption, accumulation, and redistribution, taxation, etc. even with a few thousand agents you can see many interesting effects of convergence and other results starting from various random starting points. Bonus points if your ideologies of economics do not produce feudal serf economies in your models.

Michael,

Between the content and comments, this is one of my favorite blogs. It speaks to the intelligence of the readers here that discussion of politics and economics can be deep and remain civil.

I’m one of those who don’t believe the US’s economic/debt problems will be solved, and so I’m much more interested in speculating on what specific things will happen when the shit hits the fan, when that might happen, and how best to prepare for it.

You mentioned that you’re preparing accordingly, but didn’t follow up when people asked for specifics. Was there a reason you can mention for preferring not to respond to that?

I would love to see a post from you speculating on what actually is going to happen, and how best to prepare for it.

Regards.

PS: On another topic, an officemate and I were talking about the leaked Romney video, and were thinking how refreshing it was to actually hear what the man thinks. Imagine if rather than only having access to politician’s whitewashed, carefully crafted, reviewed and filtered speeches, we more often got to hear them speaking naturally.

I’m confused. You cite the USA Inc. Report, and yet you seem to disagree with it’s conclusion? I haven’t had time to read the report but have watched the video a few times.

The conclusion seems to be that the government can get itself out of debt if it increases revenue (taxes), cuts costs and makes smart investments. But you seem to be concluding that a complete collapse of our government and economy is inevitable?

Personally, I’m more attuned to the specious end of a perspective than a radical one.

I like that the second chart here shows entitlement spending being cut by efficiency. That gives me hope that Obamacare will continue to work over the next decade.

I also like that Obama’s plan commits to the KP/USA Inc. solution. https://www.politify.com/election/national

Oh yeah, and THANK YOU for sharing that USA report… I feel like a better American for seeing it and have been sharing it with people too.

Nice work thank you

Up to this point you have shown that there are very big unfunded liabilities of up to $47T. But then you say “it doesn’t matter how much you tax the rich” concluding that the only way is to limit the entitlements. From your post this conclusion comes without evidence. We would need another figure that would show what would happen to the tax revenues if the carried income was repealed, the top fed income bracket was raised,capital gains tax is raised etc.

The question “Can these $47T of future liabilities be funded from raising taxes?” remains unanswered.

(I am not commenting on the moral side of this question but just from the accounting one)

“As I’ve said before, go for it! Destroy the rich. Take it all.” Who wants to ‘take it all’. That’s a strawman argument. you provided stats and graphs. but you didn’t prove that romney (gop) plan is anything but what you stated.

Thankyou, well said. We have a grim reality to face. We are facing a bleak future unless we man up and accept a few realities. This isn’t rich vs poor. The bottom line is we ALL need to pay in more and expect less. There is some logic in short term tax breaks to speed up the recovery but the reality is if you like social programs (I do believe strongly in them, having grown up in the UK and seen them work) you have to accept they need to be paid for. Just the same way tax breaks have to be paid for.