TechCrunch Disrupt champion Shaker, an Israeli virtual world startup, has closed a $15 million round of financing. The round was led by Shervin Pishevar at Menlo Ventures. CrunchFund was already an investor in Shaker, and participated in this new round as well.

Other investors in this round include Eric Schmidt’s Innovation Endeavors, Troy Carter and Rami Beracha from Pitango.

Here’s the TechCrunch post about Shaker winning Disrupt last month, and here’s their launch post and demo video.

The company was founded in Israel but recently opened a San Francisco office, which will be the new company headquarters. Shaker was founded by Ofer Rundstein, Yonatan Maor and Gad Maor.

Pishevar has a serious crush on the company. I asked him to tell me why he invested, and how he first met the team. In his own gushing words:

I was blown away by talent of the Shaker team. I’ve been searching for many years for what only Shaker has accomplished. We at Menlo Ventures are excited to be leading this major investment in Shaker. Shaker is the human serendipity engine. Shaker is going to touch and transform human connection and entertainment worldwide.”

Mike, so here’s the crazy story of how I met them. I was working on scouting a Jedi Council retreat in Cabo. I met these amazing guys from Mexico at Summit Series who are were working on an entrepreneurs resort. I began mentoring one of them, Bear. He wanted to learn how to become an investor and VC in the future. My advice was to go forth and travel around the world scouting for amazing startups and bring it back. I didn’t expect to hear from him for months. Instead, a mere 3 weeks later he had traveled to Egypt and Israel, and I flew into Burning Man. He said, “Shervin, I listened to you! Thank you! And I found this amazing startup, Shaker. And they are flying into the Playa tonight and they are competing in Techcrunch Disrupt!” That night I met them and was very impressed with them and their vision. But with no connection I had to wait until the following Tuesday to get the demo at a Samovar in San Francisco. Within a minute, I knew what I saw was the future. I had been looking for this for years. Their product execution was nearly flawless. A very hard feat to accomplish given the vision. The next day I brought them in to meet the rest of the Menlo partners. They agreed and we were off! Meanwhile, while we tried to come to an agreement on an investment, Shaker won Disrupt! I actually got the term sheet done and signed from the streets of Haiti the following weekend while I was volunteering in Haiti for jp/hro! Hopefully, there will be karma in that and all of the serendipity that brought us together.

I am very excited that Shaker is my first major investment at Menlo! Go Shaker!

Why’d we invest? Like Airtime, Shaker addresses the difficulty in meeting new people on the Internet:

“We are trying to address the problem of what has happened the last 10 years of social media,” says Parker, who was also the founding President of Facebook. “Your social network has become more rigid and constraining.” Airtime, it seems, will be more about meeting new people. “Facebook is about identity, the people you already know,” says Parker. “It has little to do with people you don’t know.”

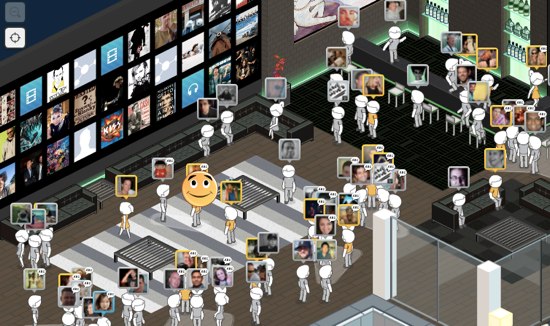

Shaker is a virtual world where you can meet new people using your Facebook identity (picture and basic information). It’s strangely addictive. And we’re very excited to be investors.