I’ve been spouting off a bit lately on politics and I keep making the same arguments to people, one at a time, on Twitter and Facebook. I’m aggregating some of them here so I can point to it later.

First, I’ve recently said I won’t vote for a Republican again unless the candidate explicitly approves of gay rights and is pro choice.

That doesn’t mean I support all (or most, or even many) of the core beliefs of Democrats. I’m with them on the social rights stuff, and I’ve made it clear that those issues matter enough to me that I’ll hold my nose and vote for a Democrat, or not vote at all.

But this tax stuff is just ridiculous.

1. The Tax Base.

Wealthy Americans pay almost all the taxes in the U.S. Only about half of Americans pay federal income tax at all.

A lot more pay payroll and state and local taxes, but it’s a specious argument to say that it’s the same thing.

If you don’t know what specious means, look it up. Don’t just glance over it because it’s the core issue.

The federal budget is financed with debt and with the income tax. Payroll taxes are used to pay social security and unemployment.

When only a fraction of the population pays taxes democracy will break down. See “A democracy cannot exist as a permanent form of government. It can only exist until the majority discovers it can vote itself largess out of the public treasury. After that, the majority always votes for the candidate promising the most benefits with the result the democracy collapses because of the loose fiscal policy ensuing, always to be followed by a dictatorship, then a monarchy.”

This isn’t revolutionary France, where the poor were incensed over being taxed. The argument now has assumed that only the wealthy pay the big taxes. The discussion is just that they should pay more.

2. The Rich Don’t Pay Enough.

This is a complicated argument that ends up boiling down to sound bites. Warren Buffett made it all worse by confusing all kinds of stuff.

I wrote about it here.

The super rich don’t pay much in taxes. But the sort of rich really get crushed. Mostly because the super rich and the poor/middle class team up to screw them bad.

People with relatively large incomes (think $500k or $1m/year) pay lots of taxes – 35% of their 2012 income, for example.

Everyone’s running around now saying that the rich don’t really pay that rate, though. Again, Warren Buffet really added fuel to this fire when he said he paid a lower rate than his secretary.

But that’s because he’s super rich. The super rich are super cool with higher taxes, because they don’t rely on income each year. They already have tons of money, so even a higher capital gains rate isn’t much of a bother. Just don’t say “wealth tax” to them, they’ll freak out fast if you do.

And there’s a huge gaping hole in the tax code that allows private equity types to take their income as capital gains, which usually means a 15% rate. This is the carried interest exception and it stinks.

That single exception allows people like Mitt Romney and Warren Buffet to pay a very low tax rate on massive amounts of income.

Buffet could have come out explicitly against just that, but instead he more generally said we need to tax the rich more.

When in fact the high income earners are already taxed way too high relative to everyone else.

That’s why people like me don’t bother with normal income any longer. The government takes too much of it, it’s not even worth earning.

I make almost all my money on carried interest via CrunchFund. And I’m telling you right now that it’s undertaxed. It should be taxed at normal income tax rates.

And I’m ok with it if the carried interest exemption goes away (as are lots of VCs who understand how odd it is).

Why? Because it’s more fair. And also because I have stored wealth, which the government can’t touch without implementing a wealth tax or through inflation. A wealth tax won’t happen any time soon. Inflation already is.

3. Inflation.

The biggest threat to my wealth is, simply, inflation. Inflation eats economies, kills wealth, and rewards debtors.

The biggest debtor is the U.S. government. Which is why they secretly don’t mind a little inflation.

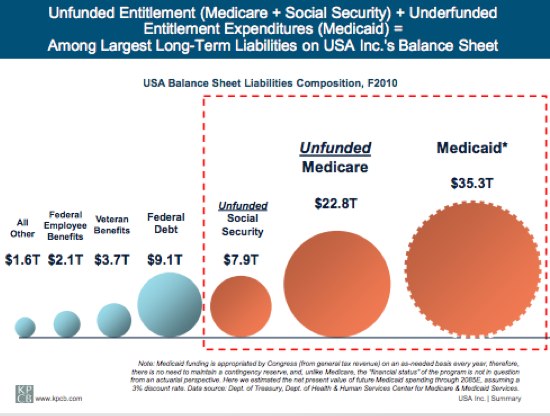

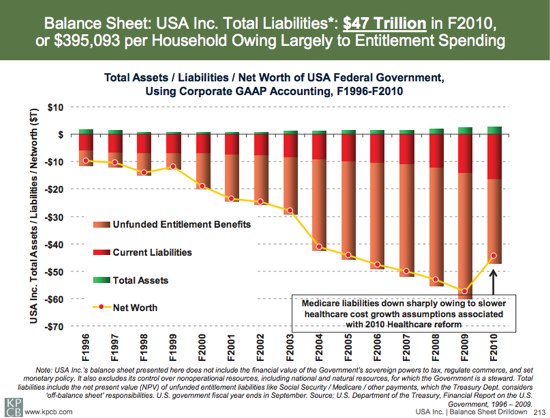

The only way to pay the vast amount of debt we have is through inflation. It doesn’t matter if you close the carried interest exemption, or if you tax the high income types into the middle class. That might seem fair but it doesn’t solve the tens of trillions of dollars in unfunded liabilities we have as a country.

The only way to fix it, other than inflation, is to lower spending. And that means crushing entitlements. Even defense spending isn’t enough to make a real dent in things.

No matter what happens to the rich in this country, one thing is clear – entitlement programs as we know them are going to end. Either because we won’t be a functioning country any more, or because government will finally be forced to change them.

Update: Kill The Rich! It Feels Good!

My former TechCrunch colleague Nik Cubrilovic has been on a roll lately.

My former TechCrunch colleague Nik Cubrilovic has been on a roll lately.

Great news today about our portfolio company

Great news today about our portfolio company  It was late 2005 that we had our

It was late 2005 that we had our

Unless you count the feel of my light sabre chainsaw in my leather sheathed hands as I prepare to take on the Zombie Apocalypse. You can see it in my

Unless you count the feel of my light sabre chainsaw in my leather sheathed hands as I prepare to take on the Zombie Apocalypse. You can see it in my

Oh, this brings back memories. It seems like yesterday that

Oh, this brings back memories. It seems like yesterday that  I had a problem this week. I rolled into town for TechCrunch Disrupt with my two dogs Laguna and Buddy, two largish (mostly) Labradors.

I had a problem this week. I rolled into town for TechCrunch Disrupt with my two dogs Laguna and Buddy, two largish (mostly) Labradors.